This is the third in a series related to Forisk’s Q4 2016 forest industry analysis and timber price forecasts for North America.

What is a tree worth? For timberland investors, the value of a tree is determined by the returns on the capital committed to owning, growing and marketing the tree. For manufacturing firms that rely on wood as a raw material, value depends on the profitability of selling the finished products they produce. Forisk’s research into the forest product industry’s “ability-to-pay” for wood raw materials speaks to this value, and the profitability of markets that use the timber products sold by timberland investors.

The economics of the forest products industry remind us that timber raw materials go into products with widely varying margins. Higher recent price levels for lumber and structural panels have increased operating margins for OSB (24%) and plywood (26%), while fluff pulp and linerboard facilities, based on current end product prices, generate margins closer to 60% to 44%, respectively. Wood pellets and SYP lumber hover below 10%. [Note: this snapshot does not show how margins cycle over time, between manufacturers, and across local wood baskets. In addition, it does not account for common “discounting” by sales teams, especially in the pulp and paperboard sectors.]

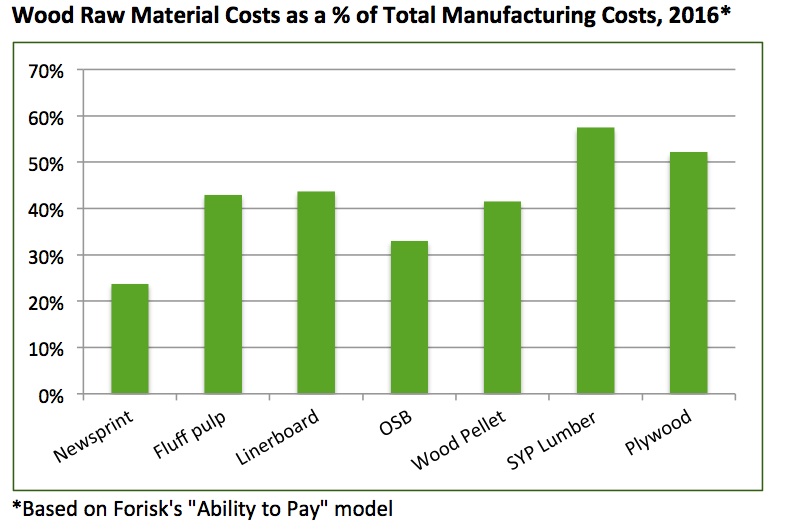

In addition, wood varies widely as a percent of total manufacturing cost across products. Given manufacturing and wood costs as of mid-2016, sawmills and plywood plants have a higher percentage of costs associated with wood raw materials, followed by wood pellet plants and fluff pulp facilities (see figure). Changes in relative pine grade-to-pulpwood prices and yield assumptions – the tons of wood required per unit of finished product – are critical to this analysis across mill types. While sawmills usually have higher percentages of costs associated with wood raw materials, improving yields, greater market shares held by lower cost producers, and relatively low pine sawtimber prices regionally reduced this percent for now.

This post includes data and analysis from “Forisk Facts & Figures” – Forisk’s quarterly “story in three slides” – a chapter in the Q4 2016 Forisk Research Quarterly (FRQ). To learn more about the FRQ, click here or call Forisk at 770.725.8447.

Looking at operating margin is misleading. This approach ignores capital. The right way to look at this is cash return on cash invested per unit of wood input. That will show that saw milling and pellet making require less capital invested than other processes which means they have similar or better returns than P&P.