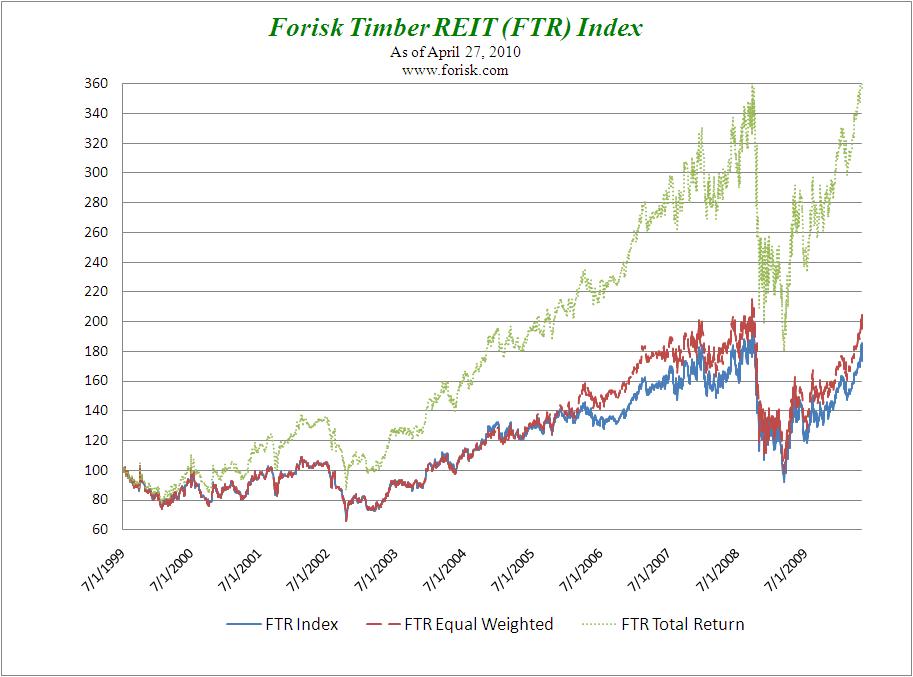

Forisk’s market cap weighted FTR (“footer”) Index of publicly-traded, timberland-owning real estate investment trusts (timber REITs) fell 0.48% over the past week as Plum Creek (PCL), Potlatch (PCH), and Rayonier (RYN) released earnings information and absorbed new assessments from ratings agencies.

Plum Creek announced 1st quarter earnings of $0.54 per diluted share while revenues declined 32.6%. Increased revenues from the timber and manufacturing portions of the business were offset by a sharp 63% decline in real estate revenues. Moody’s raised Rayonier’s rating from Baa3 to Baa2, thereby confirming a stable outlook for the firm. Potlatch’s wood products segment generated quarterly operating income for the first time since the 3rd quarter of 2008 on increasing lumber sales volume and pricing. In addition, interest in non-strategic timberlands and rural real estate remained stable during the quarter.

Leave a Reply