Institutional and individual investors often ask, “what is the difference between investing in timberlands directly and buying stock in publicly-traded timberland-owning real estate investment trusts (timber REITs)?” In brief, one is direct ownership of a hard asset while the other is a claim on the earnings of a timber-growing and selling business. In practice, these investments perform differently – over shorter time periods – and their accessibility varies for different types of investors. (Jeff Opdyke of the Wall Street Journal addressed some of these issues in “Wealthy investors discover timberland,” May 1-2, 2010).

During the first quarter of 2010, publicly-traded timberland and real estate investments outperformed private timberlands, as measured by the NCREIF Timberlands Index (Figure 1). However, short-term analysis of these indices can provide misleading signals as the NAREIT and FTR Indices track the daily performance of public equities, while NCREIF reports quarterly on appraised, realized and cash returns from a sample of the private US timberland investment market. This fact highlights the liquidity gap, which manifests itself as a short-term constraint on transacting assets, between the public and private timberland markets.

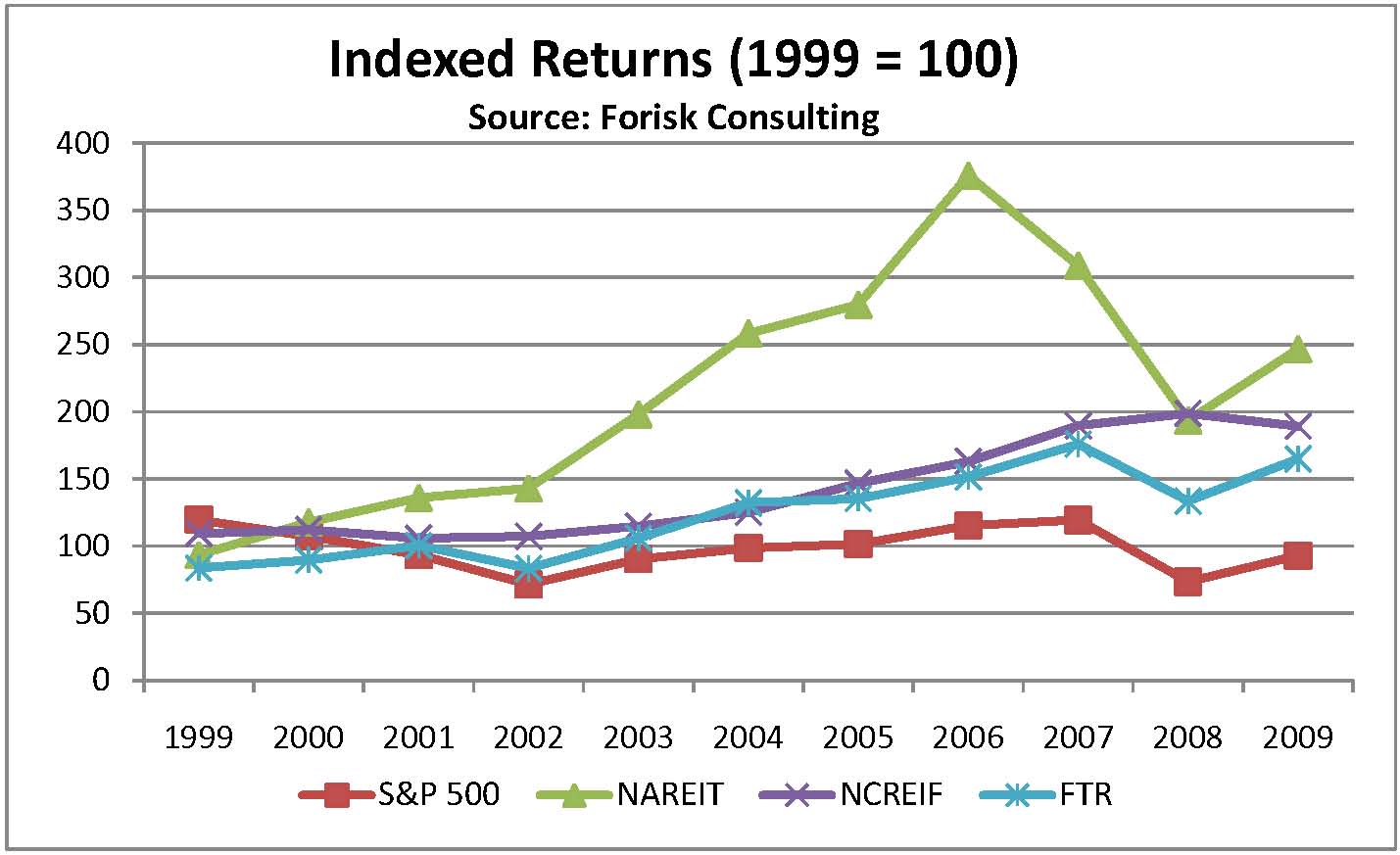

Figure 2 summarizes indexed annual returns since 1999. Even at the annualized level, returns demonstrate the extreme difference in volatility across asset classes as public REITs (NAREIT) climbed through 2006, crashed through 2008, and continue to recover in 2010 (Figure 1). Interestingly for timberland investors, private and public timber-related assets have converged over this particular 11-year time frame.

In addition, the FTR Total Returns Index, which includes dividends, returned 13.9% annually since 1999.

Leave a Reply