Managing the risk of forestry and timberland investments fits with the “circular flow of funds” approach to financial management, which focuses on two fiduciary objectives. One, raising and supplying the funds required for timber-related investments on favorable terms. Two, using these funds effectively and efficiently to maximize returns to the investors. In short, raise money at low rates and invest it in trees at higher rates. Simple, right?

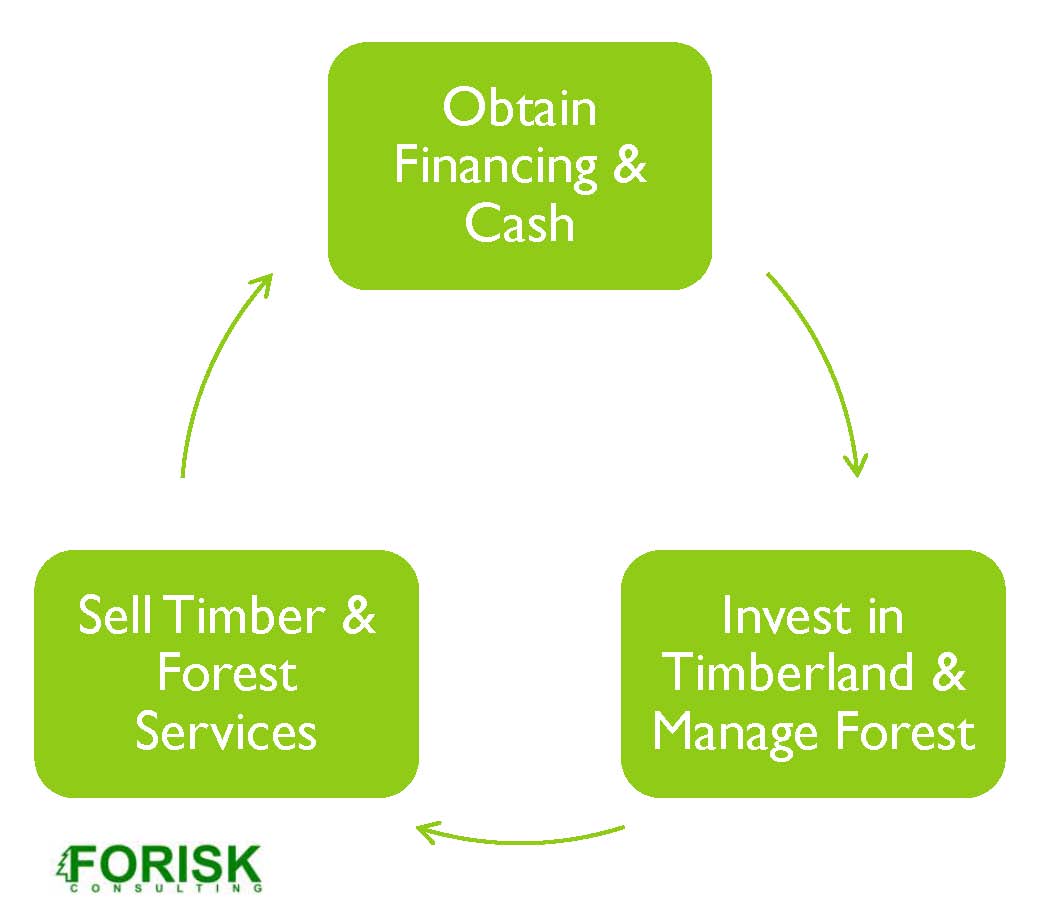

In practice, successfully achieving these objectives depends on a smooth flow of funds – from cash to non-cash assets (forests) back to cash – within the investment. This can be dreamily viewed as a circular flow of funds (see figure), unending from fund inception. The cycle continues, assuming no disruptions, which may include, for example, a shortage of funds, difficulties in finding suitable timberland properties, forest operations challenges (weather, mechanical), and timber market issues (prices, wood demand, mill curtailments).

In practice, successfully achieving these objectives depends on a smooth flow of funds – from cash to non-cash assets (forests) back to cash – within the investment. This can be dreamily viewed as a circular flow of funds (see figure), unending from fund inception. The cycle continues, assuming no disruptions, which may include, for example, a shortage of funds, difficulties in finding suitable timberland properties, forest operations challenges (weather, mechanical), and timber market issues (prices, wood demand, mill curtailments).

How do we measure timber investment success from this perspective?

- Cash flow circulates uninterrupted.

- Circle of cash grows in size.

- Speed of cash flow accelerates.

- Circle continually spins off cash for other investments.

- Performance of the timberland investment meets broader portfolio objectives, such as diversification or preservation of capital.

Thus, a critical benefit of the “circular flow of funds” approach is that it permits and facilitates – in fact, it requires – quantitative measurement of investment performance against specific, prioritized timberland investment objectives. In sum, it provides an effective way to keep score.

*This topic will be addressed in further detail during the “Applied Forest Finance” short course on August 4, 2010 in Atlanta, Georgia. For more information, click here.

Leave a Reply