“Inflation at 44-Year Low” trumpeted today’s headline from the Wall Street Journal. The news was pause-worthy at our shop because one of the most common arguments for investing in timberland is its purported potential to hedge inflation. Well, does it? And if inflation is so low, does that reduce the potential attractiveness of timberland investments?

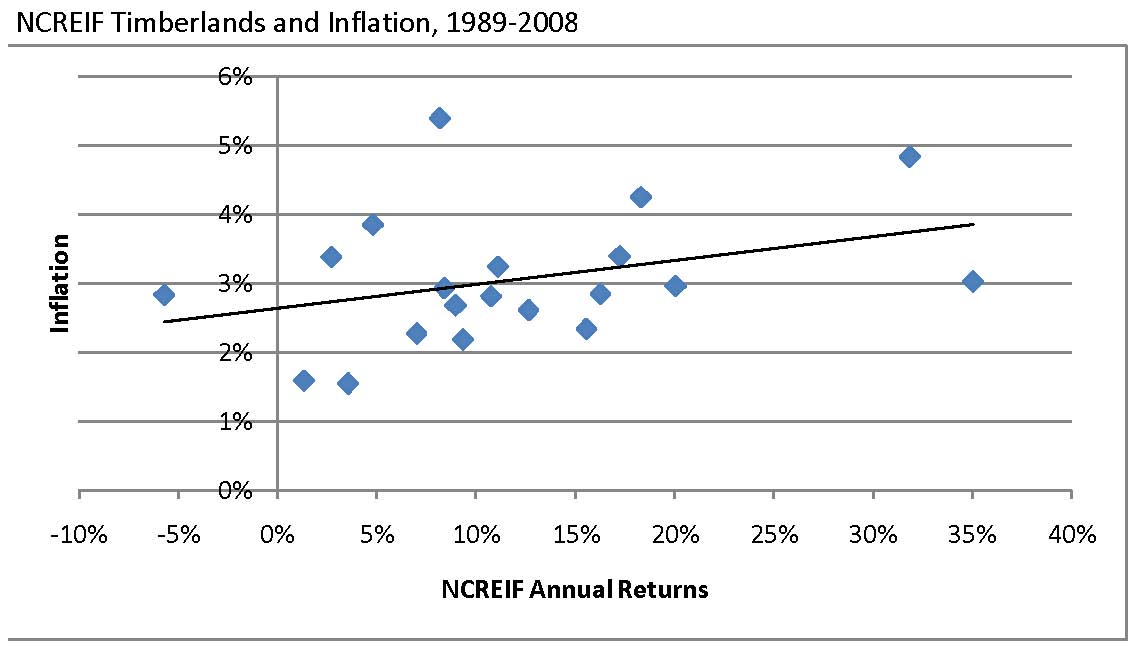

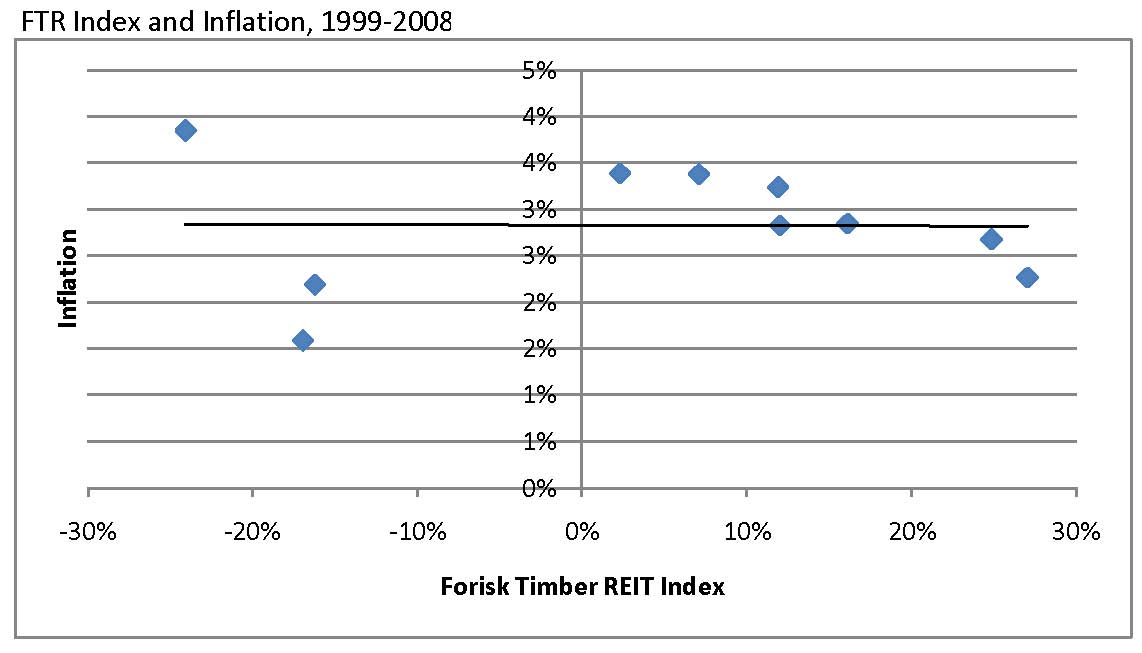

Previous research indicates that timberland investments may hedge against unexpected inflation. The seminal academic paper in this area, “Do Forest Assets Hedge Inflation?” by Court Washburn and Clark Binkley (Forest Science, August 1993), asserted that timberland assets, especially those in the Pacific Northwest and South, hedge “higher-than-anticipated inflation.” In 2007, forest economist Jack Lutz affirmed a positive correlation between timberland returns and inflation, concluding that timberlands will “preserve capital in the face of rising consumer prices” (Forest Research Notes, 3rd Quarter 2007). Forisk revisited this issue last year with similar results for direct timberlands (first figure “NCREIF Timberlands and Inflation”), but different results for an alternative timberland investment vehicle: publicly-traded timberland-owning REITs (second figure “FTR Index and Inflation”).

Returns from direct timberland investments, as measured by the NCREIF Timberland Index, correlate positively on an annual basis with inflation; public timber REITs, as measured by the FTR (“footer”) Index, lack a similar relationship over the past ten years. Key factors: the differences in owning hard land assets versus super-liquid public equities.

What about current rates of inflation? The fact that inflation is low today has no relevance to timberland’s potential for mitigating exposure to inflation in the future. The play is against “unexpected” inflation, not consensus expectations.

*This theme will be addressed further during the “Applied Forest Finance” and “Valuing Timber REITs” courses on August 4, 2010 in Atlanta, Georgia.

Leave a Reply