Several years ago, an analyst from a hedge fund called me to discuss suitable discount rates for timberland investments. We had the following exchange:

“A common error with discount rates is that folks use real and nominal rates inconsistently,” I said.

“Who cares? Mixing real and nominal is just a rounding error,” responded the analyst.

Ex-squeeze me? Baking powder? Clearly distinguishing real rates – which do not include inflation – from nominal rates – which do include inflation – in our forestry and timberland valuation models matters tremendously. While the impacts of inflation over short time periods (i.e. under one or two years) may be irrelevant, the effects of inflating costs and revenues over a 10-year timberland investment or 30-year forestry rotation do represent the difference between a mountain and a molehill. The error manifests itself when valuation models assume inflation in costs, but not in revenues, or vice versa. An example, please.

Assume a brief, 5-year timberland investment with the following characteristics:

- Price paid: $1,000 per acre

- Harvest volume: 5 tons per year

- Average stumpage price, net: $20 per ton

- Taxes & administration: $10 per acre per year

- Real discount rate: 6%

- Inflation: 2%

- Nominal discount rate: 8.1%

- Price sold: $1,000 per acre (in real terms)

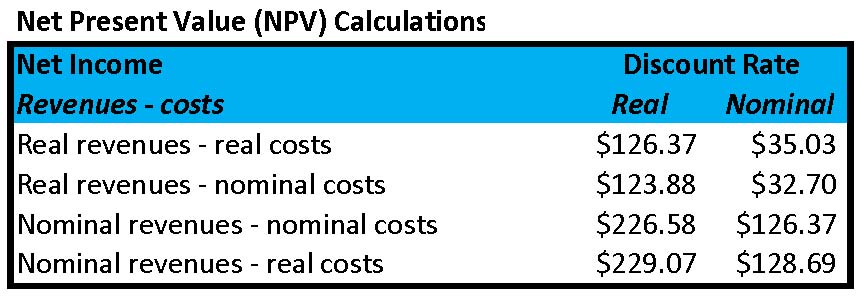

The table below shows the range of potential NPVs resulting for mixing real and nominal revenues and costs, in addition to discounting annual net cash flows (“net income” in this example) with real versus nominal rates.

Note that using real revenues, real costs and a real discount rate produces an NPV of $126.37, which is identical to using nominal revenues, nominal costs and a nominal discount rate. The key is consistency.

*This theme will be addressed further during the “Applied Forest Finance” and “Valuing Timber REITs” courses on August 4, 2010 in Atlanta, Georgia

Leave a Reply