Days after Plum Creek (PCL) posted second quarter earnings on July 26th (see “Plum Creek Beats the Street“), the balance of the timber REITs – Potlatch (PCH), Rayonier (RYN) and soon-to-be-REIT Weyerhaeuser (WY) – reported their results. Neena Mishra, Forisk’s Director of Equity Research, assesses their performance relative to expectations:

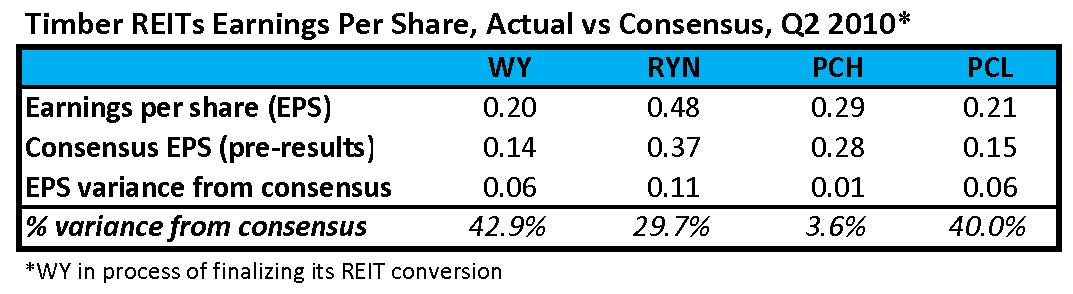

Second quarter earnings from WY, RYN and PCH made it a clean sweep for the timber REIT segment. Including PCL, all firms beat consensus expectations (see figure). As a group, timber REITs exceeded consensus earnings per share by 29% for the quarter.

On July 29, 2010, RYN reported net income at $39 million, or $0.48 per share, ahead of the street consensus by 11 cents. The Timber segment benefited from higher prices, stronger export demand and lower costs. Performance Fibers income, up 30% from one year-ago, reflected strong demand more than offsetting a decline in prices. On the other hand, Real Estate revenues and operating income were down from the prior-year quarter, primarily due to a reduction on non-strategic timberland sales. RYN appears to be well-positioned relative to its peers as a significant portion of its earnings derive from Performance Fibers, which continues to enjoy growing demand for its cellulose specialties and absorbent materials products.

PCH also reported results for the quarter on July 29th. Net income came in at $11.7 million, $0.29 per diluted common share, compared to $3.8 million, $0.09 per diluted common share, for the quarter one year ago. The results, which beat consensus by a penny, were driven by higher harvest volumes, improved sawlog pricing and the run-up in lumber and plywood pricing. PCH announced a sale agreement for ~41,500 acres of Wisconsin and Arkansas timberland to RMK Timberland Group for ~$29 million. The company also signed an option with RMK to sell ~46,500 additional acres in the fourth quarter for ~$35 million.

On July 30, 2010, WY reported net earnings of $42 million or $0.20 per diluted share (excluding special items), compared to a net loss of $106 million, or $0.50 per share, for the same period last year. The results exceeded consensus by six cents. Strong performance by the Cellulose Fibers segment (due to higher price realizations) was somewhat offset by weaker results from Timberland and Wood Products. Log markets strengthened early in the quarter due to higher wood demand from mills and improved export markets but weaker markets for wood products later in the quarter affected net results. The company expects weaker results from Timberland, Wood Products and Real Estate in the third quarter, but substantially better earnings from Cellulose Fibers due to higher prices. Finally, WY’s REIT conversion is on track and payout of the special dividend is expected on September 1, 2010.

We liked the results but, as noted in our previous post on PCL, discouraging housing data after the expiry of the home buyers tax credit lead our cautious outlook in the near term. Record low mortgage rates and lower housing prices (resulting in higher affordability) have yet to offset the pessimism and practical restraints from the weak labor market. Long term, however, timber REITs remain attractive for income-oriented investors as fundamental drivers for long-term wood demand and land remain in place.

Leave a Reply