From the desk of Neena Mishra, Director of Equity Research:

While investing directly in timberlands requires high starting capital, retail investors can choose from other vehicles which provide exposure to timber and forest products such as REITs, related C-Corporations or ETFs (exchange traded funds). The suitability of these vehicles depend on the capital, liquidity and cash flow requirements, as well as the tax situation, of the investor.

Currently, there are two primary ETFs related to timber: Guggenheim Timber Index ETF (CUT, launched in November 2007) and iShares S&P Global Timber and Forestry Index (WOOD, launched in June 2008).

CUT tracks the performance (before Fund’s fees and expenses) of the Beacon Global Timber Index. The Index is designed to track the performance of common stocks of global timber companies. All stocks in the Index are selected from the universe of global timber companies that own or lease timberland and harvest that timber for commercial use and/or sale of lumber, pulp, paper, packaging, and other forest products. The fund currently has 27 securities and a weighted average market capitalization of $3.2 billion. The exposure to U.S. companies is 31.36% currently (as of September 30, 2010).

WOOD tracks the performance (before Fund’s fees and expenses) of the S&P Global Timber and Forestry Index. The Index is comprised of 25 global publicly traded companies that own, manage, or are involved in the “upstream supply chain” of forests and timberlands. The Index constituents may be forest products companies, timber REITs, paper or packaging products companies, or agricultural product companies. As of September 30, 2010, the exposure to domestic companies is 46.42%.

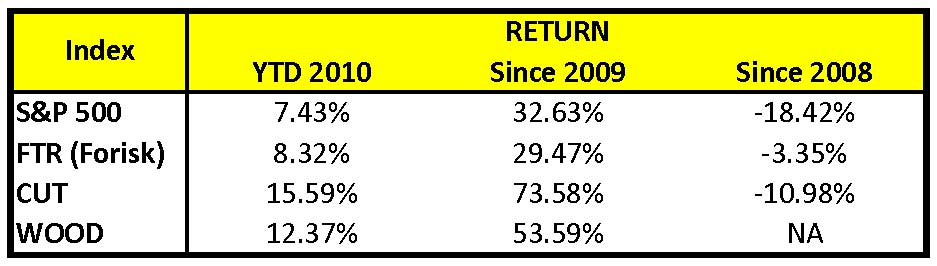

The table below shows the comparative YTD (as of close of November 3, 2010), since 2009 and since 2008 performances of the ETFs versus the FTR Index (Forisk Timber REIT Index, market weighted Index of the three publicly traded timber REITs) and the S&P 500.

Please note: these ETFs do not provide a good proxy for investing directly in timber. In addition to tracking firms that own timberlands, they maintain a substantial exposure to manufacturing companies. Compared with CUT, WOOD has a greater weighting towards domestic producers and contains more pure-play timber names. The difference in the performances as seen in the table stem from differences in exposure to markets (global versus domestic) and sectors.

Leave a Reply