Launched in 2008, the Forisk Timber REIT (FTR) Index tracks the performance of publicly-traded timberland-owning real estate investment trusts in the US. Firms qualify for the FTR Index – which currently includes Plum Creek (PCL), Rayonier (RYN) and Potlatch (PCH) – upon inception/conversion to REIT status. Weyerhaeuser (WY), which has completed all necessary steps to adopt REIT status, technically becomes a REIT upon filing its tax return in 2011 and electing REIT status effective January 1, 2010. WY will be included in the Index effective the date shareholders can buy and sell shares of WY as a REIT.

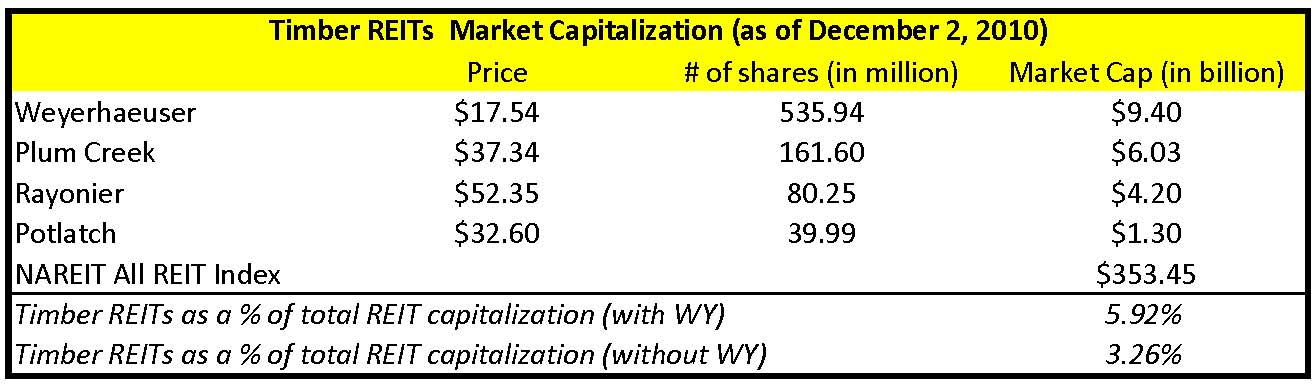

The FTR Index currently constitutes 3.26% of total public REIT capitalization. With Weyerhaeuser, the timber REITs will constitute 5.92% of total public REIT capitalization (see table). YTD, the FTR Index has returned 8.08%.

The Specialty Sector Index within the FTSE NAREIT Composite Index currently has six REITs, including the three timber REITs, and constitutes 5.8% of the Composite Index. Effective December 20, 2010, the FTSE NAREIT Specialty Index will be discontinued and the FTSE NAREIT Timber Index will be created as a new Property Sector within the FTSE NAREIT All Equity REIT Index.

Weyerhaeuser and Plum Creek are currently constituents of the S&P 500 Index (which includes the 500 largest public companies representing ~75% of the US equities market, with a total Market Cap of $10,951.10 billion) while Rayonier and Potlatch are constituents of the S&P MidCap 400 Index (which includes mid-sized companies covering over 7% of the US equities market, with a total Market Cap of $1,079.49 billion). The S&P 500 has returned 7.04% YTD while the S&P MidCap 400 Index has returned 21.28% YTD.

The three timber REITs and WY are also constituents of the S&P Global Timber & Forestry Index, which includes 25 of the largest publicly-traded timber and forestry companies in 10 countries, with a total Market Cap of $100.13 billion. This index has returned 12.83% YTD.

Leave a Reply