Timberland and timber REIT investors continue to wade through erroneous and underreported analysis in financial outlets. For example, a December 31, 2010 article, “Worst Performers in S&P Led by Weyerhaeuser, Dean Foods & H&R Block,” from Barron’s claims Weyerhaeuser (WY) stock lost 56% in 2010, when in fact shareholders earned 16.6% for the year. That makes two years in a row for Barron’s. An August 2009 article, “Trouble in the Forest”, on timberlands from Barron’s demonstrated a limited grasp of timberland investment characteristics and mathematics, confusing timber – the growing trees – and timberland, and citing a potential decline in timber prices “of as much as 50%” without detailing assumptions, offering evidence, or providing the most basic analysis of readily available data with which to inform and educate readers and investors as to why these assessments fail rudimentary screening.

What are the facts as they relate to WY? In connection with its REIT conversion, Weyerhaeuser paid a special dividend of $5.6 billion in September 2010. The dividend value per share was $26.47 (in cash and stock combined). On the ex-dividend date, July 20, 2010, WY’s share price adjusted to reflect this stock dividend (from $41.83 per share as of close of July 19, 2010 to $15.76 as of open on July 20, 2010). After adjusting the prices for the special dividend, WY actually returned 16.64% to the investors during 2010.

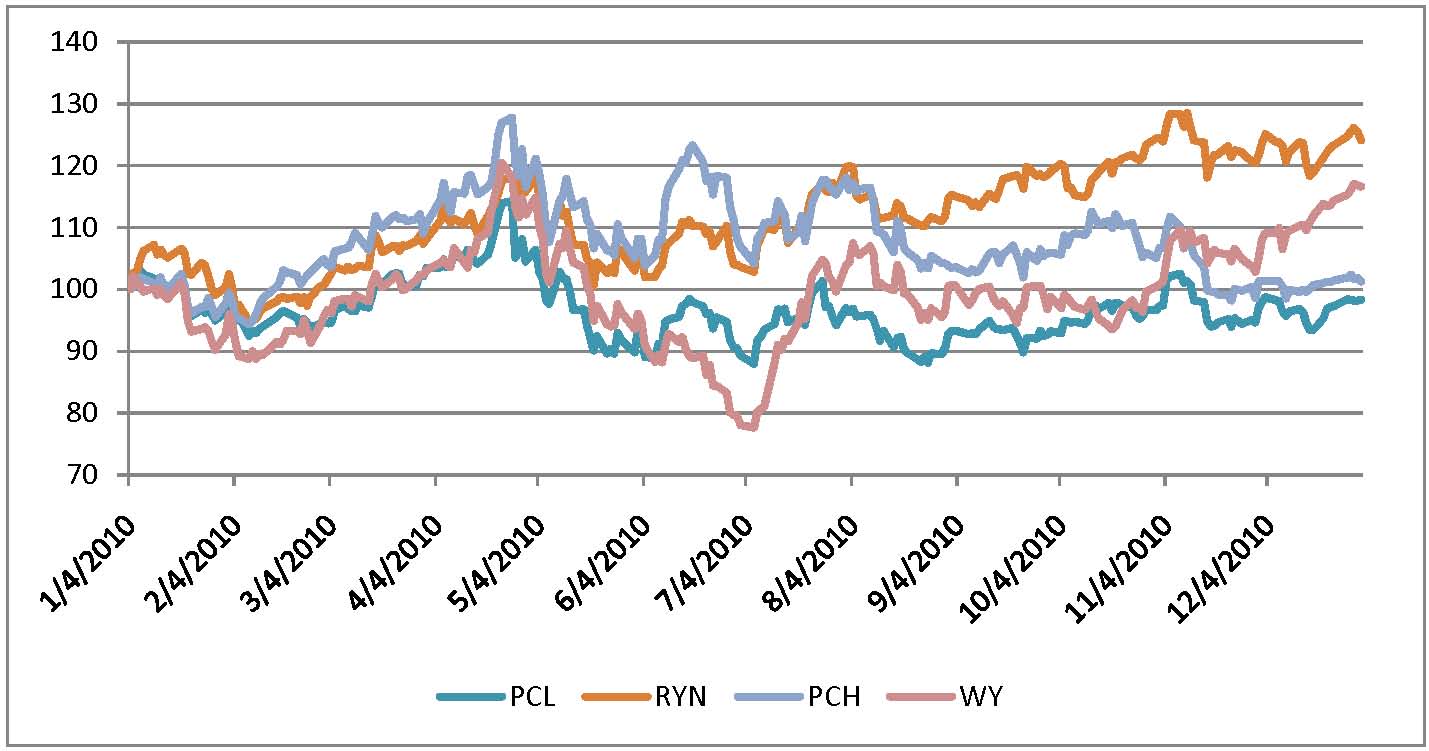

The chart below shows the comparative performance of the three publicly traded timber REITs: Plum Creek (PCL), Rayonier (RYN), Potlatch (PCH); and Weyerhaeuser, which had effectively become a timber REIT and has been added to the FTR Index effective January 3, 2011.

Leave a Reply