REIT investors specify the relatively high and stable dividends as a key benefit of investing in real estate investment trusts. Timberland-owning REITs (timber REITs) offer additional tax benefits. Most timber REIT distributions (related to income from the sale of timber) are treated as long-term capital gains and taxed at relatively lower tax rates compared with ordinary dividends.

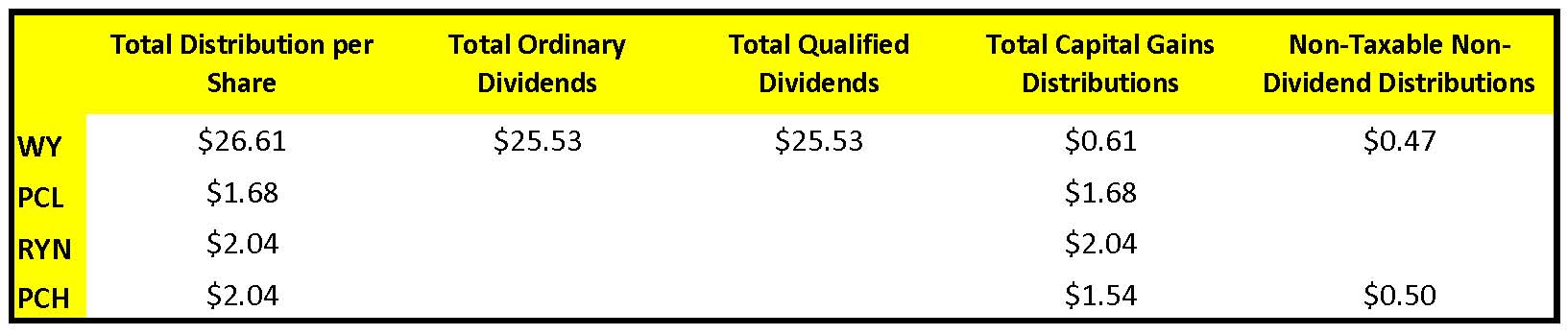

Weyerhaeuser (WY, which will elect REIT status in its 2010 tax filing) and the three publicly-traded timber REITs – Plum Creek (PCL), Rayonier (RYN) and Potlatch (PCH) – announced the tax treatment of dividends paid in 2010. The following table breaks down the dividends by firm:

For PCL and RYN, 100% of the dividends paid will be treated as capital gains. WY paid a special dividend of $26.46 per share as required for its REIT conversion (see previous post for details). Of this, $0.46 per share (including the regular quarterly dividend of $0.05 per share) is treated as capital gains, $0.47 per share is attributed to Earnings and Profits of the company prior to March 1, 1913 (treated as a non-taxable distribution) and the remaining $25.53 per share is treated as ordinary income and taxed accordingly. For PCH investors, $0.50 per share (24.5% of the total distribution) will be treated as return of capital, while the balance will be treated as capital gains (related to income from the sale of timber).

For further details on how timber REITs typically fund dividend distributions, please see our earlier blog on this topic.

Leave a Reply