Last week, I spoke at the Global Real Assets Investment Forum in New York as part of the panel on “Timber in Institutional Portfolios.” My takeaway from participating in this event: institutional investors seem bored with timberlands. They showed more interest in other real asset categories, such as commodities, infrastructure, water and gold. Why the indifference to our panel? Talking with investment managers produced three types of answers:

- “We already invest in timberlands.”

- “We hear pitches from timberland investment managers regularly.”

- “We’re looking for higher rates of return.”

In short, audience members already know the asset class.

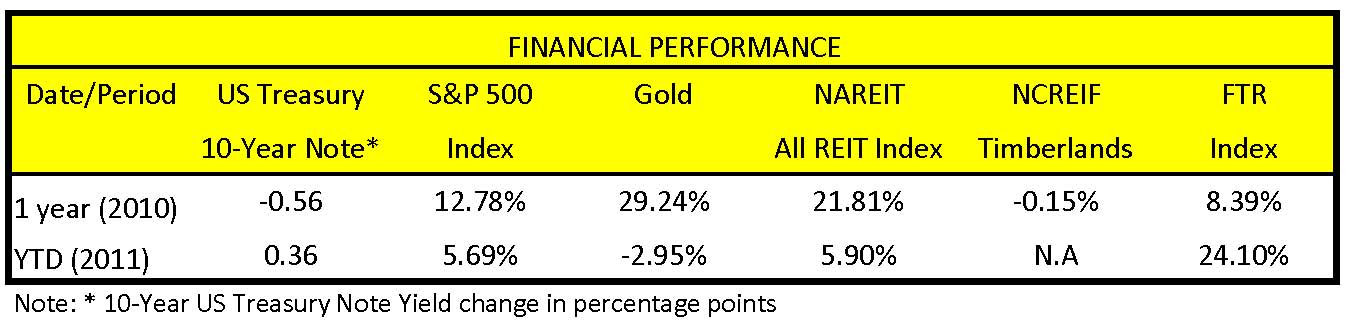

Interestingly, timberland-owning REITs – which have outperformed Lady Gaga year-to-date – generated few questions. Regardless the slow housing recovery, the Forisk Timber REIT (FTR) Index of public timber REITs has returned 24.10% year-to-date compared with 5.69% for the S&P 500 (as of February 11, 2011).

Reasons for the relative outperformance of this asset class include:

- Heightened inflation concerns fueled the rally for asset classes such as Gold and Timber, which are viewed as inflation hedges;

- Rising demand for timber and lumber in China, resulting from its rapidly growing economy and decreased timber imports from Russia;

- On the supply side, the impact of the Mountain Pine Beetle infestation on timberlands in Western Canada, particularly in British Columbia, which historically sourced about a third of the lumber for US housing markets. This turn of events benefits US lumber manufacturers;

- Due to the housing slump, timber REITs deferred harvest and shifted the harvest mix towards lower priced pulpwood, where prices remained relatively stable (for a detailed study on this topic, click here). By doing so, these companies deferred cash flows while the timber assets continued to grow. So, when housing markets recover, these firms will benefit from increased harvest levels and improved pricing.

While the short-term outlook for timber remains slightly negative to stable, the medium-to-longer term outlook appears opportune, which drives interest in the sector.

Leave a Reply