An interesting report landed on our desk a few weeks ago, further reinforcing the sorry state of timberland market analysis available to timber REIT investors. The report, from Credit Suisse, makes assertions based on a careless and faulty application of basic statistics, and demonstrates a rudimentary understanding of forest growth and harvesting over time.

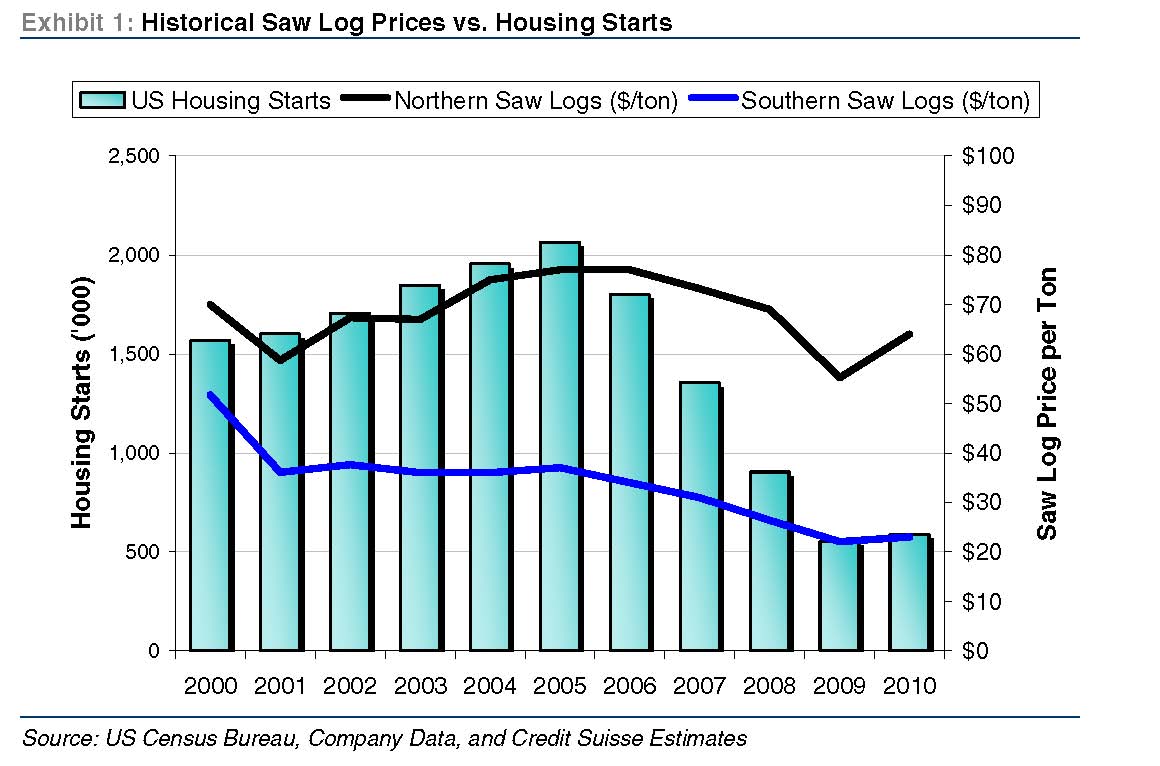

Lead author Chip Dillon looked at, among other things, the relationship between housing starts and log prices. He states that the evidence “… shows the lack of correlation between US housing starts and saw log prices.” The supporting exhibit in the Credit Suisse report (below) contradicts this assertion. It indicates an unmistakable, positive relationship between housing starts and log prices in the US South and North.

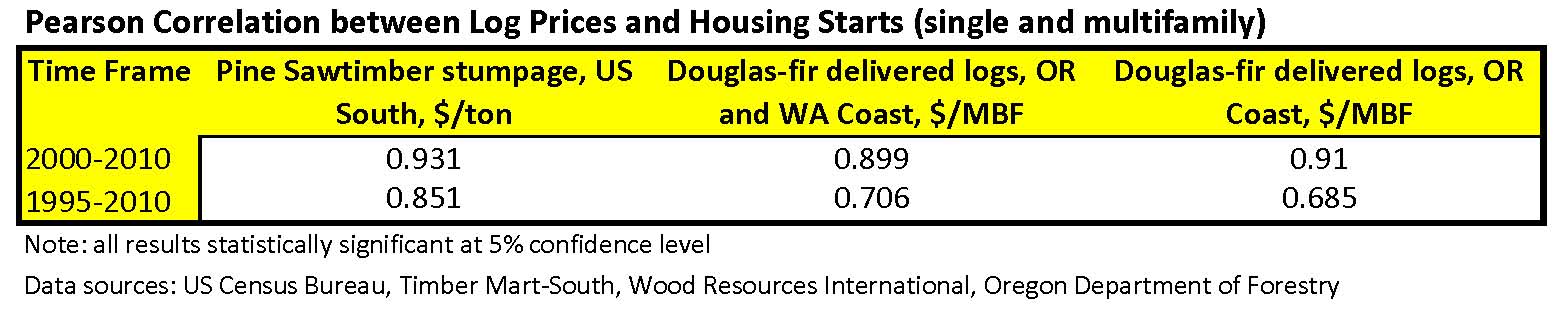

Since the report failed to include any quantitative analysis to assess the degree of this relationship, our Forest Economist, Dr. Tim Sydor, decided to run the numbers. Using readily available data (and twenty minutes with an Excel spreadsheet), the results confirm Mr. Dillon’s assertion as faulty: housing starts and log prices, over this time frame in the US, did in fact demonstrate a significant statistical correlation. The table below summarizes the results:

The report generated additional questions from our team and clients. “Timberland acres are shifting from tobacco farming to timberlands and driving up supplies?” “Are we really running into a wall of wood from deferred sawtimber harvests?” Again, we turn to the data and math behind forest growth to make the following observations:

Timberland acreages in the US South, the land of tobacco and cotton farming, remained virtually unchanged between 1977 and 2010. Acres declined ~1% if compared with 1953.

The future inventory of sawtimber (logs for lumber) includes two parts. First is the currently deferred sawtimber inventory. Second are today’s small log (pulpwood) trees. Deferring harvest of sawtimber increases future inventories, but a concurrent increase of harvests of pulpwood trees (to replace the loss of residual chip flows from sawmills) effectively decreases future inventories of sawtimber trees.

Since a typical age of harvested sawtimber trees in the US South is ~25+ years, it is useful to look further than four years, the time frame of the Credit Suisse analysis, prior to judging the importance of temporary harvest deferrals. A point of reference: in 1992, the US South produced 13 billion board feet (BBFT) of softwood lumber. By 2000, this increased 28% to 16.7 BBFT. In 2005, it further increased 14% to ~19 BBFT.

Our analysis of the data indicates the forest industry – including timber REITs and timberland investors – “ate” into the inventory for sawtimber inventories on private timberlands in the US South during the housing run up. In assessing the future performance of timberland assets as housing markets return, we see a more sophisticated picture that varies highly across timber REITs (click here for the summary).

Leave a Reply