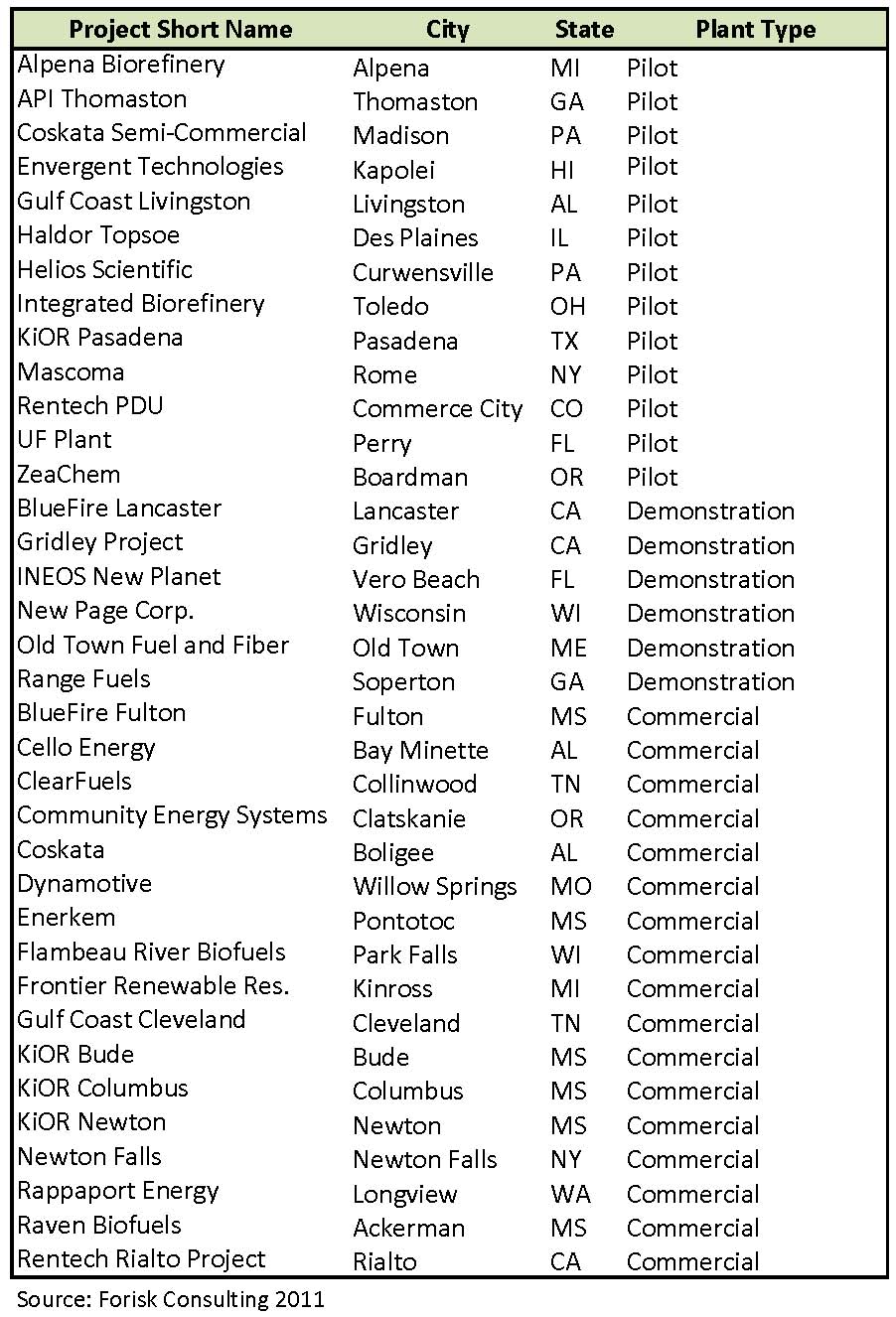

Last week, Pasadena, Texas-based KiOR filed with US regulators to increase the size of its initial public offering to $200 million, doubling its initial filing of $100 million in April (KiOR doubles size of IPO, Reuters, June 1, 2011). KiOR plans to produce crude oil using non-food biomass types such as wood chips and switch grass. In addition, KiOR was included in a study published last month – Transportation Fuels from Wood: Investment and Market Implications of Current Projects and Technologies – that includes the status of 36 cellulosic biofuel projects in the US, commercialization timelines for 12 technology approaches, and implications for bioenergy and timberland investors. The list shows all projects covered in the study.

For each technology, the study ranks the level of technical risk, provides a commercialization timeline, and estimates the expected yields at commercial scale. The results indicate that major technical hurdles need to be solved and will delay or disrupt commercialization for most of the technologies under development.

What were the implications for firms such as KiOR? KiOR currently operates a pilot plant in Pasadena. The firm is developing commercial scale biorefineries to make gasoline and diesel blendstocks from wood. Its initial-scale plant in Columbus, Mississippi is under construction. KiOR has secured three off-take agreements for fuel produced at its Columbus location with Hunt Refining Company, Catchlight Energy, and FedEx Ground Services. The company also plans commercial scale facilities in Mississippi (likely in Newton and Bude), Georgia, and Texas. KiOR received a $75 million interest-free loan from the state of Mississippi to build the Columbus plant. KiOR received a term sheet for a DOE loan guarantee for $1 billion announced in February 2011. As of May, the loan guarantee was in the due diligence process and requires that KiOR begin construction by September 30, 2011.

With both strong public and private sector backing, KiOR has the potential to be a successful biofuels company. However, our technology assessment indicates a high level of technology risk and that commercialization could be at least eight years into the future. In addition, the firm produces end products that require additional refining; these are not drop-in fuels. Finally, the increased IPO simply gets KiOR closer to the capital it must have to give the commercial scale facilities any chance of completion, regardless of whether or not the technology functions and yields materialize as planned.

Relative to other firms in the study, KiOR has a shorter technology gap as the overall results find an 11 year gap on average between estimated technology viability and firm announcements.

For more information about this study, please click here.

Leave a Reply