Who buys the trees grown by timberland-owning REITs? Timber REIT returns depend on strong demand from end-use markets for forest products such as lumber, plywood, pulp and OSB. This explains the dependence that timber REITs have on housing markets. Low demand for new construction equates to low demand for wood-based building products. As the man said on School House Rock, “the knee bone is connected to the shin bone……”

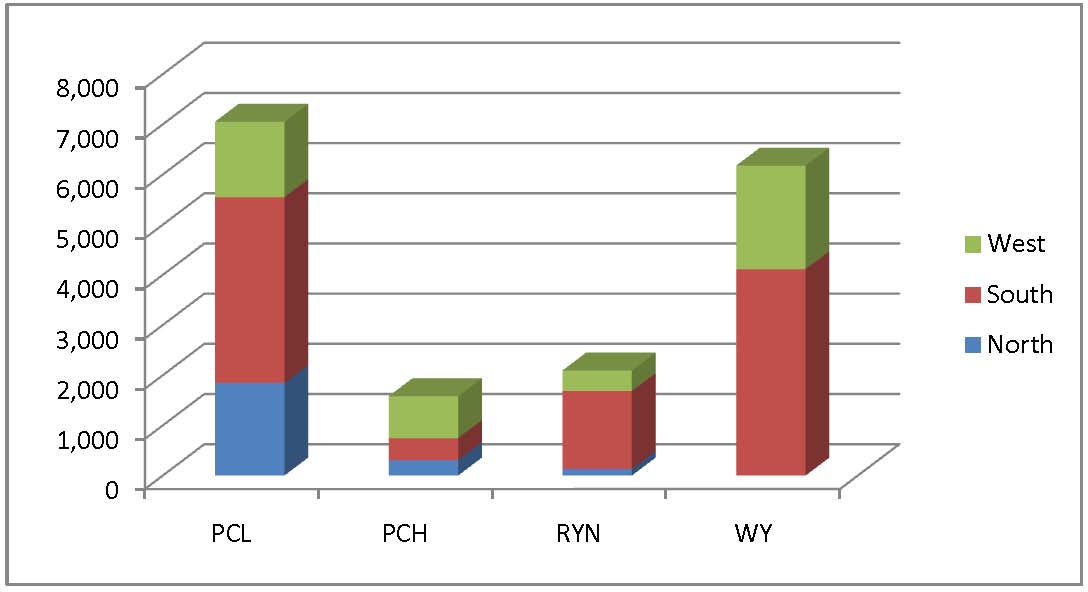

From the point of view of an individual forestland owner, wood demand is also a function of the proximity of wood-using mills relative to the timberland property. From an economic standpoint, the value of the trees grown depends wholly on the ability of nearby mills to pay for and convert these trees into higher valued products. Timber REITs, which own timberlands in multiple markets throughout the US and across states, are simply aggregations of multiple local markets, rolled up into a portfolio of timberland ownerships. As seen in the figure below, timber REIT forest assets vary across and within regions with respect to forest characteristics, end market opportunities, and current and future timber prices.

The figure highlights data in thousands of acres:

To learn more about timber REIT assets, strategies and valuations, participate in the “Investing in Timber REITs” workshop on August 23rd in Atlanta.

School House Rock! That brings back good memories. Another interesting blog.