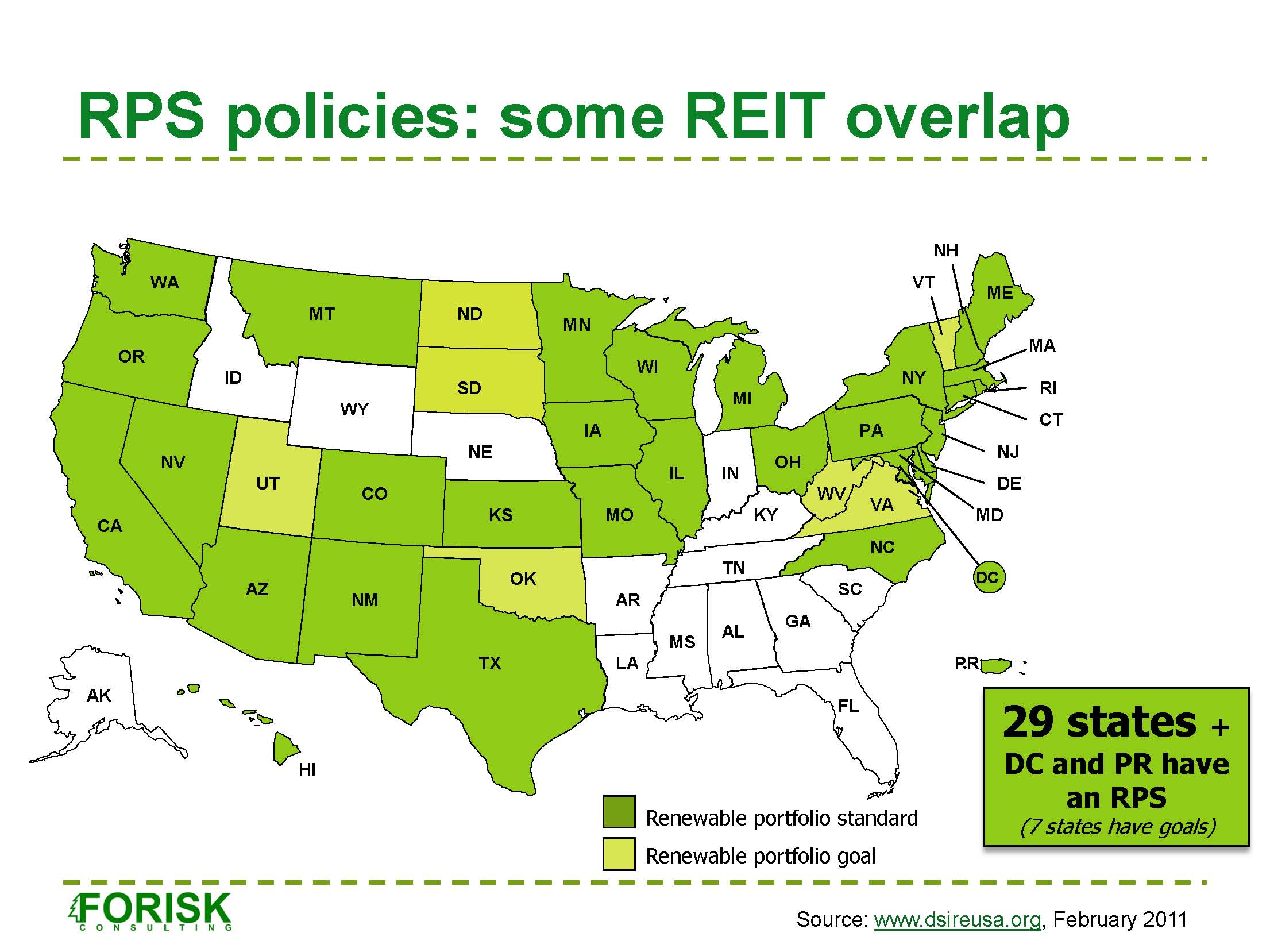

The four publicly-traded timber REITs in the US – Potlatch (PCH), Plum Creek (PCL), Rayonier (RYN) and Weyerhaeuser (WY) – own timberland in 24 of the 50 states. Where do these assets sit relative to evolving wood bioenergy markets that could provide additional demand for timber? One way to look at this is to consider where the timber REIT ownerships sit relative to states with legislative mandates, called “Renewable Portfolio Standards” (RPS) and initiatives, referred to as “Renewable Portfolio Goals”, in place for increasing the generation of renewable energy.

The DOE-funded Database of State Incentives for Renewables & Efficiency (DSIRE) publishes updates on programs and incentives that promote renewable energy and energy efficiency. This includes maps that summarize activities at the state level (see map). Where do current policies overlap with timber REIT forests?

- States with timber REIT timberland: 24

- States with RPS (29) or renewable portfolio goals (7): 36

- Timber REIT states with RPS (11) or renewable portfolio goals (3): 14

To learn more about timber REIT assets, strategies and valuations, participate in the “Investing in Timber REITs” workshop on August 23rd in Atlanta.

Leave a Reply