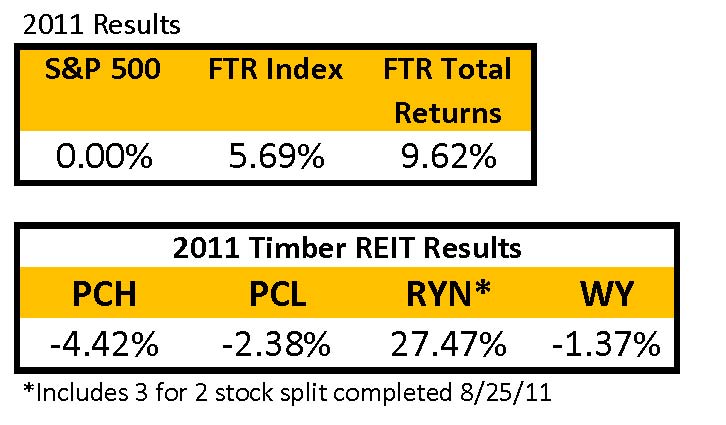

In 2011, timberland-owning REITs, as a sector, outperformed the S&P 500. As measured by the Forisk Timber REIT (FTR) Index, publicly-traded timber REITs returned 5.69% versus 0.00% for the S&P (see tables). The FTR Total Returns Index, which accounts for dividend distributions, earned 9.62% in 2011.

While the timber REIT sector performed well, individual firm performance varied. Not including distributions, Rayonier (RYN) alone generated positive, stand-alone returns of 27.47%, which accounts for a mid-year 3-for-2 stock split. The other three timber REITs generated negative returns of 1 to 4 percent. The primary distinction between RYN and its timber REIT brethren is the relative size, magnitude and profitability in 2011 of its specialty performance fibers division.

Leave a Reply