Nobel Prize-winning physicist Albert Einstein once said, “the hardest thing in the world to understand is the income tax.” On the other hand, actor Wesley Snipes reportedly said, “taxes are only complicated if you pay them.” (Actually, that might have been Wesley’s cellmate while they served time for tax evasion.) Lucky for investors in timberland-owning REITs, the Tax Man’s bite hurts less than for other REITs and dividend-paying stocks that are subject to ordinary income tax rates.

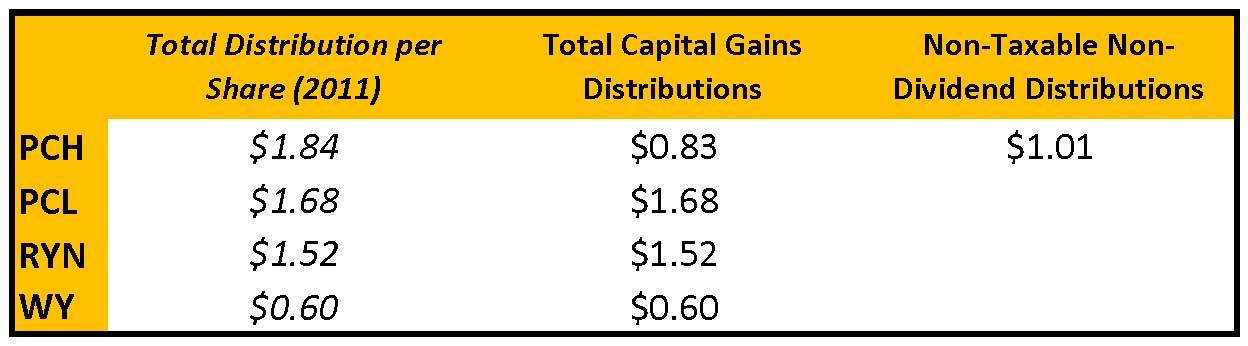

Most timber REIT distributions (related to income from the sale of timber) are treated as long-term capital gains and taxed at relatively lower 15% tax rates compared with ordinary dividends. Recently, all four public timber REITs announced the tax treatment of dividends paid in 2011:

For Plum Creek (PCL), Rayonier (RYN) and Weyerhaeuser (WY), 100% of the dividends paid in 2011 will be treated as capital gains. For Potlatch (PCH) investors, $1.01188 per share (54.955878% of the total distribution) will be treated as return of capital, while the balance will be treated as capital gains.

Click here to learn more and register for “Applied Forest Finance” on February 9th in Atlanta, Georgia.

Leave a Reply