This is the first in a three-part series related to the financial performance, current trends and changing structure of the timberland investment sector.

While trees continue grow, timberland values continue to fall. In the world of mortals, every financial return and policy development implicates current timberland investment vehicles and future capital allocation decisions. As an analyst reviewing the data and observing events in the field, I hear Earl Weaver, the former Baltimore Orioles’ manager, screaming in my ear, “Everything changes everything!”

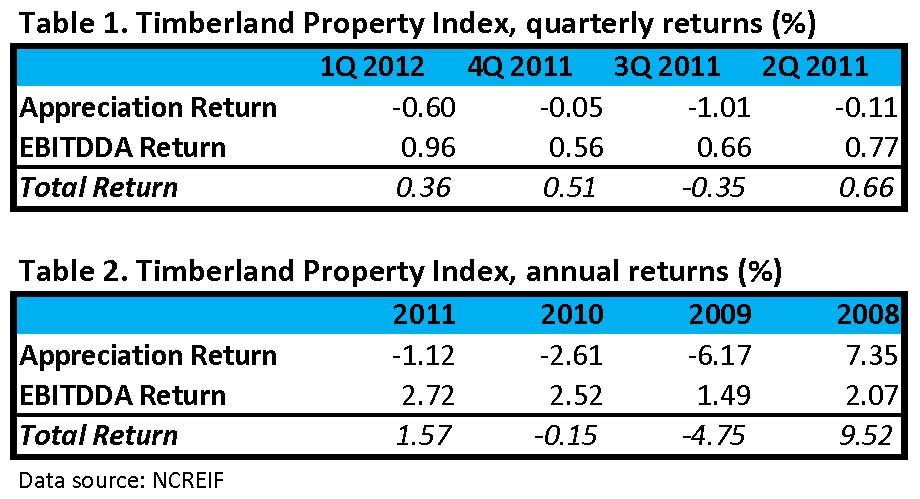

Recent returns from the NCREIF Timberland Index affirm that turmoil reigns in timber. For four consecutive quarters, NCREIF has reported negative appreciation returns for private US timberlands (Table 1). And for three consecutive years, NCREIF reported negative appreciation returns for private US timberlands (Table 2). Meanwhile, these timberlands continue to generate on the order of 1.5 – 2.5% annual cash returns.

Turmoil reflects uncertainty and confusion, and timberland returns, even in the face of positive signs from housing markets, incur disquiet. While cash returns improve with increased harvest volumes and stronger stumpage (timber) prices, timberland appreciation builds on prices paid – and received – by institutional investors. So where are we?

High transparency undermines high growth. In the US, forestry investment professionals understand the market, which remains undersupplied with timberland relative to demand from institutions and available capital. The purgatory – this (temporary) period of miserable waiting and scratching at Excel valuation models – resolves itself when the market decides whether or not timberland is a “6% business.” If investors expect or demand 6% real returns from new acquisitions, then math dictates additional depreciation in timberland values.

Part II addresses a paradox in US timberland ownership and how this effectively reshapes the timberland investing sector.

Leave a Reply