This is the third in a three-part series related to the financial performance, current trends and changing structure of the timberland investment sector.

Newspaper headlines scream distractions. They make us forget that investments in timberland assets are somewhat insulated from every daily front page story, regardless the tenor or topic. However, investments in publicly-traded timber REITs have tremendous exposure to the moods of the market. The driving distinction, like the difference between owning a soup factory versus holding shares in Campbell’s, is liquidity. Liquidity provides a pathway to extract opportunistic profits and to inflict instantaneous losses.

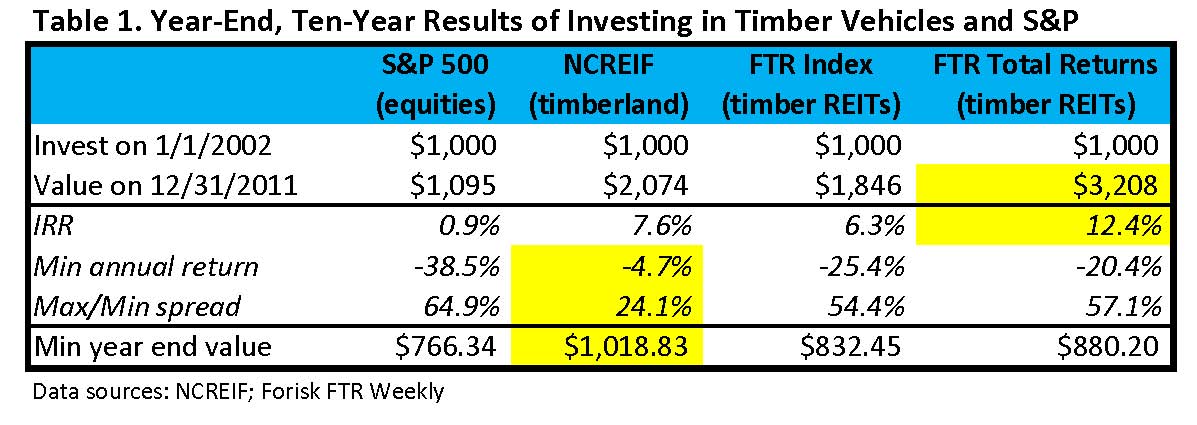

US timberland markets continue to seek firm ground (see Private Timberland Purgatory). In response, investors now pursue alternate, sector-shaping investment strategies, while picking through a tangle of low timberland supply, high timberland demand and few ready deals (see Timberland Ownership Paradox). They also revisit the relevance and tradeoffs of investing in public timberland-owning real estate investment trusts (timber REITs). By the power of Grayskull (and Excel), Table 1 captures, in hypothetical 10-year plays, key benefits and exposures of private versus public timberland investments.

The results emphasize important realities and reminders for investors. First, timber vehicles outperformed the S&P over the 10-year holding period across all metrics. Second, liquidity unnecessarily burdens open-eyed long horizon timberland investors. While private timberlands do not offer the “upside” available to liquid equities, they do provide sturdier protection. Not once in the example did private timberland investors fall into the red. Third, public timber REITs demonstrate total internal rates of return (IRR including dividends) exceeding 12% with less volatility than the S&P 500. While the S&P investment ends below $1,000 in four years (2002, 2003, 2008 and 2009), the Forisk Timber REIT (FTR) investment ends below $1,000 just once (2002).

Implications for Investors

In the US, timber falls squarely in the domain of value and yield (income) investors. Trees grow while investors earn, assuming the strategy matches the asset. Regardless the timber investment vehicle, I observe consistent and repeated timberland investment success associated with four attributes:

- Localized asset-specific knowledge. Timber markets are uniquely local. While every Hardy Boys book has 20 chapters and every year has four quarters, each timberland asset has no guaranteed cookie-cutter market structure or return profile. These localized distinctions are relevant to both private and public timberland investments.

- Patience. Just because you became aware of timberland and timber REITs last Thursday does not mean investing on Friday is a good idea. Valuation models and price forecasts function well only if you assume you’re the only one using them.

- Diligence. Successful timber investors and managers do homework. Lots of it. Hunting opportunities includes an ongoing process of ranking timber markets, identifying potential candidate properties, studying prices and building relationships. For equity investors, this includes a process of localized timber asset valuation and firm-level benchmarking.

- Long time horizon. Timber returns, like those of any asset class, go up and down each year. However, the distinguishing characteristics of timberland assets reveal themselves over long time frames. During this time, investors manage actively, reducing costs and identifying opportunistic sources of revenue.

To receive the free FTR Weekly Summary with historical performance data in Excel, contact Heather Clark at hclark@forisk.com, 770.725.8447. Forisk will offer “Timber Market Analysis” on August 15th in Atlanta, a one-day course for anyone who wants a step-by-step process to understand, track, and analyze the price, demand, supply, and competitive dynamics of local timber markets and wood baskets. For more information, click here.

Leave a Reply