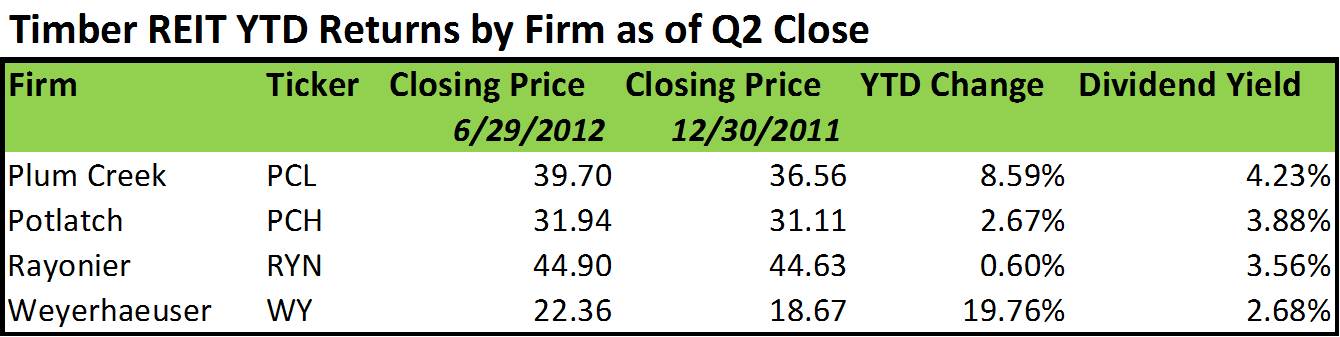

As we hit midfield for 2012 and closed out the second quarter, the timber REIT sector as measured by the Forisk Timber REIT (FTR) Index posted a 12.09% gain relative to 8.31% for the S&P 500 (click here for the free FTR Weekly Summary). While the year-to-date results vary by firm (see table), the sector benefited from (1) strong exposure to improving markets for homes and construction in key US regions and (2) attractive dividend yields relative to other industries and REIT subsectors.

For investors and analysts tracking wood and timber REIT markets, Forisk offers “Timber Market Analysis” on August 15th in Atlanta, a one-day course detailing a step-by-step process to understand, track, and analyze the price, demand, supply, and competitive dynamics of timber markets and wood baskets. For more information, click here.

Leave a Reply