This is the first in a three-part series related to Forisk’s modeling of future softwood stumpage prices in the US South and Pacific Northwest.

Increasing housing starts prime the pump during an economic recovery. The Economist magazine describes the upside for housing in the United States, noting that “its share of GDP, at 2.7%, is half the average of the past 30 years” (“The Housing Market: Pulling Its Weight at Last”, August 4, 12). We care about this because, in the timber industry, growth in housing leads to periods of strengthening stumpage prices. In addition to growing wood demand from the increased use of lumber and other building products, the constructing and buying of new homes fuel added spending on wood products such as cabinets, furniture and hardwood floors.

At Forisk, I study US housing starts as part of an explicit forecasting framework:

- Given assumptions about the US economy and housing markets,

- How will demand for wood raw materials drive stumpage prices in each local market,

- Subject to constraints and surpluses in manufacturing capacity and forest supplies.

In the end, our primary interest is the movement of stumpage prices in each local market as it plays out its role in satisfying national and export markets for forest products and wood bioenergy.

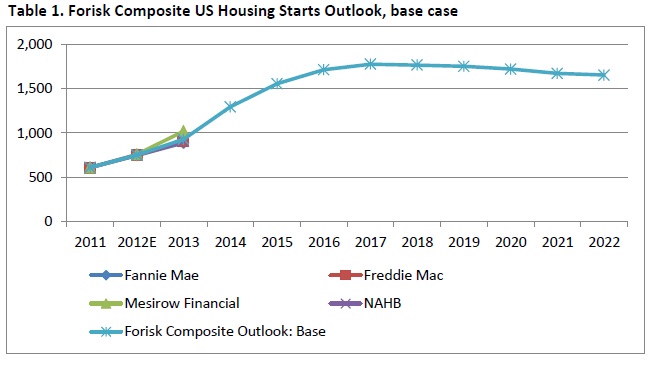

Forisk builds a composite housing starts forecast by relying on publicly-available, independent forecasts from professionals in the housing industry. These include Fannie Mae, Freddie Mac, Mesirow Financial and the National Association of Home Builders (NAHB), as well as long-term assumptions from the Energy Information Administration’s (EIA) model of the US economy (Figure 1).

In studying the impact of housing starts on markets for timber, we track how home size, wood volume use per square foot and the ratio of single versus multi-family housing affects the demand for wood products. Our August 2012 Base Case peaks at 1.78 million housing starts in 2017. In this Composite Outlook, the primary source of sensitivity is the assumed single-to-multi-family housing mix, as multi-family housing construction accelerated in response to (1) rents rising from low vacancy rates and (2) strong interest from institutional investors.

Part II addresses assumptions related to end markets for wood-using manufacturers.

Leave a Reply