This is the second in a three-part series related to managing financial risk associated with timberland investments, wood procurement and forest management activities.

Part I of Managing Financial Risk in Forestry (Real Options and a Practical Question) introduced industrial views and academic efforts related to the use of financial derivatives to manage risk in the forest products industry and timberland investing sector. Gaston, in the 1958 movie “Gigi”, captures the general forest industry sentiment when he said “if you like that sort of thing.” Regardless, derivative securities improve the liquidity of risk (if you like that sort of thing).

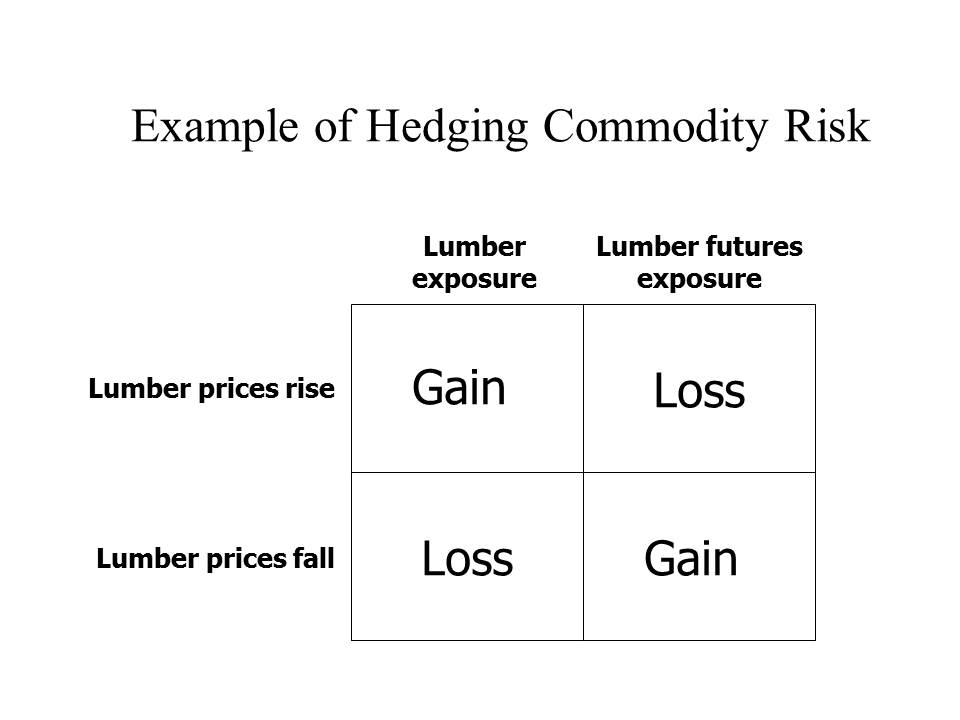

Let’s name our parts. Derivative securities “derive” their value from the prices of other underlying assets, such as stocks, bonds, currencies or commodities (i.e. wheat, gold or lumber). The most common of these financial instruments are forwards, futures and options. In theory, these derivative securities manage exposure to risks associated with the underlying assets. They do this by locking in prices and volumes in advance, thereby reducing uncertainty. For example, a lumber manufacturer can lock in prices for future lumber sales by buying lumber futures contracts traded on the Chicago Mercantile Exchange (www.cme.com). If lumber prices go up, the gain in the lumber sales price is offset by the loss from the lumber futures contract. If lumber prices fall, the loss in the lumber sales price is offset by the gain from the lumber futures contract.

When used correctly, futures and options act as a form of insurance against unexpected price movements. This phenomenon, where risk associated with one asset is offset with a position in financial derivatives, is called hedging. Alternately, “speculators” trade futures and options simply to profit from price level changes.

How can hedging strategies apply to forest management and timberland investing activities? I have conducted research and analysis on risk management in forestry and timber using derivatives related to weather (crazy, huh?), currency exchange rates, energy prices, fertilizers and stumpage prices. For example, a significant price relationship exists between urea cash prices and urea futures prices. (Urea is the most common nitrogen fertilizer used in forestry.)

Discussions with forest managers revealed that high, short-term urea prices can lead them to forgo planned forest management investments. This decision to “underinvest” relies on short-term cost and cash flow considerations. Using estimated hedge ratios, we calculate net realized urea prices for the U.S. South cash market for nine fertilization seasons over five years. [Mendell, B.C. 2006. Hedging urea for forestry applications in the US South, Southern Journal of Applied Forestry, 30(3): 142-146]

Does hedging add value to overall forestry investments? Answers to this vary. For example, the diversification of timberland investment portfolios is an operational hedge that produces clear, unequivocal benefits to investors. Alternately, the use of derivative contracts for day-to-day forest management activities works better on paper than in practice because of issues associated with the relatively small scale of individual forestry activities and the relatively large scale of standardized financial contracts.

Part III discusses the pricing of options and use of supply agreements to manage timber prices. Since 2003, Dr. Brooks Mendell has delivered keynotes and workshops throughout North and South America, in English and in Spanish, related to risk management in forestry and timberland investment markets. To schedule Dr. Mendell for your event, please contact Heather Clark at 770.725.8447 or hclark@forisk.com.

Leave a Reply