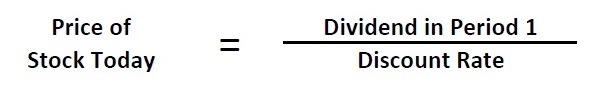

Want a simple method for valuing stocks and income earning real estate or timberland? Consider the Dividend Discount Model by dividing next year’s income, assuming it will be earned annually in perpetuity, by a constant discount rate or cost of equity.

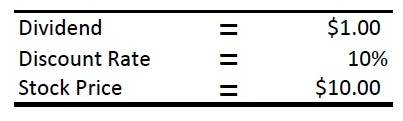

For example, assume that Forisk stock pays $1.00 per share annually in perpetuity. How much would you be willing to pay per share if you required a 10% rate of return? According to the Dividend Discount Model, you would pay $10 per share.

If we think about this model with forestry investments in mind, assume a timberland ownership generates $100 of net income per acre per year. Applying a 6% discount rate in the Dividend Discount Model ($100/6%) gives a valuation of $1,667 per acre. For those of us in timber, we can see that this approach gets us “in the ballpark” and provides a simple approach for “drive-by” valuations…..

Click here to register for “Applied Forest Finance” on February 7th in Atlanta, Georgia. The course details necessary skills and common errors associated with the financial and risk analysis of forestry-related investments. Registration includes copies of our “Forest Finance Simplified” handbook.

Leave a Reply