This is the second in a series related to Forisk’s 2013 forecast of softwood stumpage prices in the United States.

Herman Chapman, in his 1935 book Forest Finance, wrote:

Forestry is an empirical art and not a mathematical science. The two major premises upon which it rests, namely, human needs expressed in consumption of forest products, and the vital forces of tree life in their reaction to the composite factors of site including climate and soil, can be measured and predicted with only approximate accuracy.

In this quote, I hear lessons echoed by friends and colleagues in the forest and timberland industries who remind us to maintain perspective and prioritize the most important factors. Timberland investment pioneer Forrest Kellogg teaches, “It’s all about the soil!” Timber buyer and procurement forester Fred Voyles reminds us, “You’re not doing your job if you stay in the truck!” Even professional gambler Amarillo Slim – neither friend nor colleague – advised, “You can shear a sheep a hundred times, but you can skin it only once.”

While I might not talk to Slim when it comes to future prices – or anything related to money, unless I want to lose some – we acknowledge that timber forecasts depend on appraisals of the future that we develop with “approximate accuracy.” In this process, we do the best can to account for the strengths and weaknesses of the data available and the objectives across participants in forest industry markets.

From the macroeconomic perspective, housing starts critically affect timber forecasts. Increased home building leads to periods of strengthening stumpage prices through growing demand for lumber and other building products. The buying and building of new homes also fuels spending on wood products such as cabinets, furniture and hardwood floors. Ultimately, however, our primary interest is the movement of stumpage prices in each local market as it plays out its role in satisfying national and export markets for forest products and wood bioenergy.

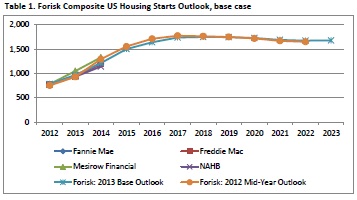

Every six months, Forisk builds a composite housing starts outlook based on publicly-available, independent forecasts from professionals in the housing industry. These include Fannie Mae, Freddie Mac, Mesirow Financial and the National Association of Home Builders (NAHB), as well as long-term assumptions from the Energy Information Administration’s (EIA) model of the US economy (Figure 1).

Our 2013 Base Case peaks at 1.75 million housing starts in 2018. For comparison, our Mid-Year 2012 Base Case peaked at 1.78 million housing starts in 2017. Overall, housing has recovered a bit quicker than forecasted in 2012 with the expectation of a slightly flatter, long-term trend. In this Composite Outlook, the primary source of sensitivity with respect to lumber demand is the assumed single-to-multi-family housing mix.

To learn more about the 2013 Forisk Forecast or Forisk’s market-specific stumpage forecasts tailored to individual wood-using facilities or timberland ownerships, contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

“Every six months, Forisk builds a composite housing starts outlook based on publicly-available, independent forecasts from professionals in the housing industry. These include Fannie Mae, Freddie Mac, Mesirow Financial and the National Association of Home Builders (NAHB), as well as long-term assumptions from the Energy Information Administration’s (EIA) model of the US economy.”

Every six months you go to the “happy face” sources that have a vested interest in painting a rosy forecast for housing starts. Clearly, this sourcing has worked well for your forecasts. Given the questionable reliability of the data from these sources (as suggested by contrarian data sources) and from the government’s economic data in general, you leave yourself exposed to the potential black swan. As statisticians, I presume you are aware of this potential and accept the risk.