This is the first in a series related to Forisk’s 2013 mid-year forecast of softwood stumpage prices in the United States.

The study and development of forecasting techniques over the past 50 years has generated few consensus findings. However, exceptions exist. For example, Professor Robert Clemen, in his detailed 1989 literature review in the International Journal of Forecasting (5: 559-583), confirms how combining multiple forecast can improve forecast accuracy. Unfortunately, improving accuracy may not equal improved understanding. Clemen observed:

….using a combination of forecasts amounts to an admission that the forecaster is unable to build a properly specified model. Trying ever more elaborate combining models seems only to add insult of injury, as the more complicated combinations do not generally perform all that well.

This summarizes an ongoing dilemma for forecasters: accuracy or understanding? The priority depends on the objective of the work. Clemen documents how applied researchers combined projections to improve estimates two hundred year ago. In 1818, the French mathematician and astronomer Pierre-Simon Laplace noted:

In combining the results of these two methods, one can obtain a result whose probability law of error will be more rapidly decreasing.

[For “trivia night” regulars: Laplace was a scientific stud. His name is one of only 72 engraved on the Eiffel Tower. Also, the video game Mega Man Star Force 3 has a wizard named Laplace.]

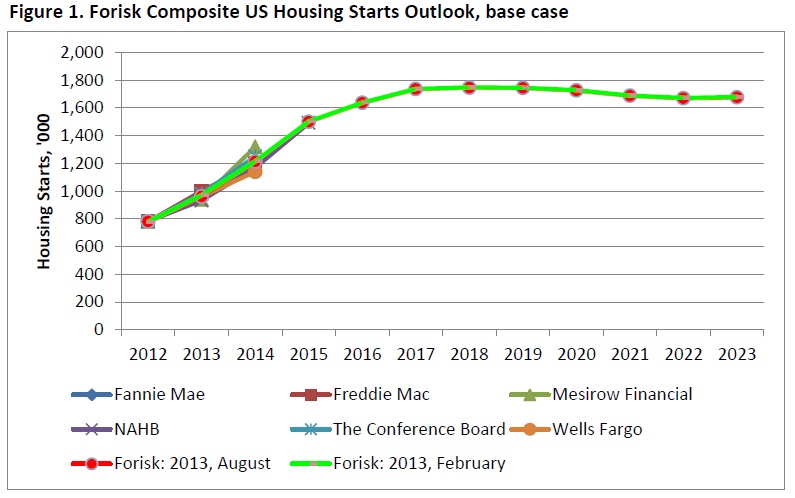

In updating our Forisk Forecast timber models each six months, we review prior projections, and apply lessons learned from both our own work and findings from decades of forecasting research. The literature on combining forecasts informs Forisk’s approach to incorporating macroeconomic assumptions. For example, the Forisk Housing Starts Outlook combines publicly-available, independent forecasts from professionals in the housing industry. As of August 2013, these include Fannie Mae, Freddie Mac, Mesirow Financial, the National Association of Home Builders (NAHB), The Conference Board, and Wells Fargo, as well as long-term assumptions from the Energy Information Administration’s (EIA) model of the US economy (Figure 1).

Our 2013 Mid-Year (August) Base Case peaks at 1.747 million housing starts in 2018. For comparison, our February 2013 Base Case peaked at 1.749 million housing starts in 2018. Overall, housing has slowed a tick, with projected totals for 2013 dropping 0.9% from 970,000 to 961,000. As in 2012, the primary source of sensitivity with respect to lumber demand is the assumed single-to-multi-family housing mix.

To learn more about the 2013 Mid-Year Forisk Forecast or Forisk’s market-specific stumpage forecasts tailored to individual wood-using facilities or timberland ownerships, contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Has Laplace compared housing starts, land prices, and timber prices to see if there is a coorelation or does one of thesae lag behind and what is that timeing?