The IRS Tax code requires real estate investment trusts (REITs) in the United States to pay out at least 90% of their taxable income to shareholders as dividends. In exchange, the IRS does not levy corporate taxes on this REIT income; taxes are paid – once – by shareholders on the dividends. This single-taxation of REIT income represents a key benefit and attraction to investors.

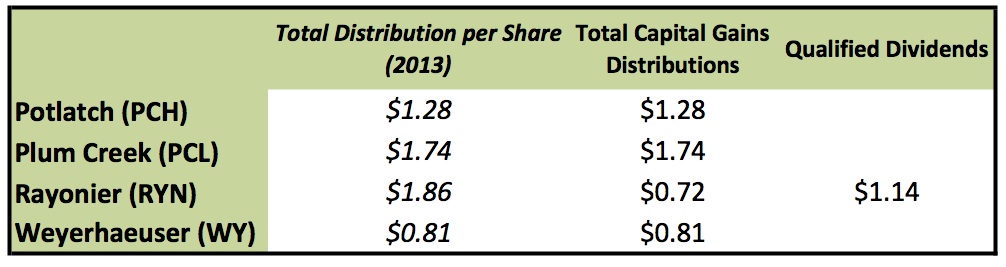

Timberland-owning REITs enjoy an added benefit. Most timber REIT distributions (related to income from the sale of timber) are treated as long-term capital gains and taxed at relatively lower 15% tax rates compared with ordinary dividends (for those in the top 39.6% ordinary income tax bracket, the 2013 capital gains rate is 20%). Recently, the four public timber REITs announced the tax treatment of dividends paid in 2013:

For Plum Creek, Potlatch and Rayonier, 100% of dividends paid in 2013 will be treated as capital gains. For Rayonier shareholders, $1.14 (61.29%) will be treated as ordinary dividends while $0.72 (38.71%) qualify as capital gains. For further details on how timber REITs typically fund dividend distributions, please see our earlier blog on this topic.

Click here to learn about and register for “Applied Forest Finance” on February 10th in Atlanta, Georgia. The course details necessary skills and common errors associated with the financial and risk analysis of timberland and other forestry-related investments.

Leave a Reply