This is the second in a series related to Forisk’s 2014 forecast of softwood stumpage prices and hardwood log prices in the United States.

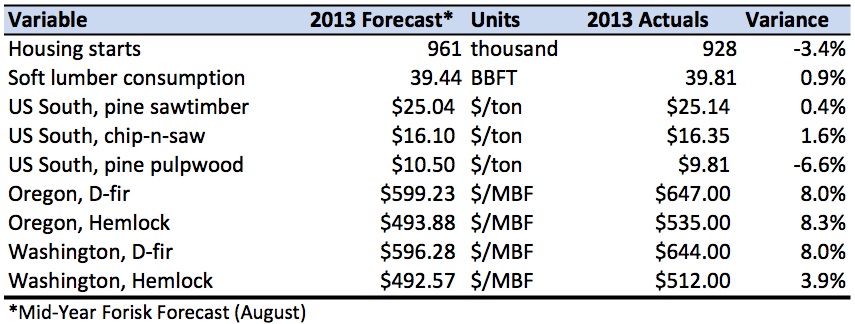

How did Forisk’s Forecast perform in 2013? For pine stumpage prices in the U.S. South, the mid-year Forisk Forecast was within 2% regionally across all grade products and 7% higher on pulpwood. Analyses of eleven state-by-state forecasts relative to Timber Mart-South annual averages shows that Forisk was, on average, $0.22 per ton lower than the actual pine sawtimber prices and $0.27 per ton lower than the actual pine chip-n-saw prices. For pine pulpwood, Forisk’s estimates for eleven state-level prices for 2013 were, on average, $1.24 per ton higher from the actuals, with two states realizing slightly higher prices than forecasted by Forisk and nine states realizing lower prices than forecasted by Forisk with the biggest gaps for 2013 occurring in North Carolina, Texas and Virginia.

For delivered softwood prices in the Pacific Northwest relative to those reported by Wood Resources International and the Oregon Department of Forestry, the mid-year Forisk Forecast was 8% lower than annual averages for three out of four state-product forecasts for 2013, and within 4% for the fourth state-product. Across categories in Oregon and Washington, Forisk underestimated the actuals for 2013 by, on average, $39.01 per MBF or 7.1%.

To learn more about the 2014 Forisk Forecast or Forisk’s market-specific forecasts of softwood and hardwood stumpage and delivered prices tailored to individual wood-using facilities or timberland ownerships in the US, contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

I do not what Forisk staff consider acceptable margins of error, but the numbers for the South look pretty darn good. Again, I do not know, but I suspect you have relatively more data to work with for the US South forecasts than the Oregon and Washington forecasts. The abundance of reliable information certainly effects the accuracy of your forecasts.