This excerpt comes from the 2014 Forisk Forecast feature article, which includes research on foreign exchange rates and capital investments in wood-using capacity.

Capital investment activity in U.S. forest industry capacity continues to increase. Announcements from 2013 alone include investments and reopenings of sawmills, OSB plants, and plywood facilities. This snapshot captures the overall trend in Forisk’s research of capital assets: forest products firms leverage existing assets to close the gap while adding new capacity to meet current and expected end product demand.

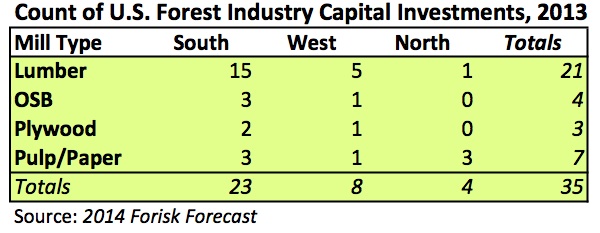

Most capital improvements at U.S. forest products facilities in 2013 were for sawmills in the South, reiterating the forest industry response to recovering housing markets (Table). In 2013, 26 companies made over $2.1 billion in capital investments at 35 facilities in the U.S. These facilities include 21 sawmills, 4 OSB/panel facilities, 3 plywood facilities, and 7 pulp/paper mills. Regionally, 66% of the projects by count occurred at facilities located in the South.

Capital improvement activity highlights another trend: Canadian lumber producers continue to actively invest in and acquire assets in the U.S. South. Four Canadian firms – Interfor, Southern Parallel, Canfor, and West Fraser – invested over $200 million in assets in the U.S. South in 2013. Not including its addition of two Tolleson facilities in 2014, Interfor acquired three Rayonier sawmills and Keadle Lumber in Georgia. Southern Parallel purchased and reopened a former Bowater facility in Alabama. Canfor purchased three sawmills in Alabama from Scotch and Gulf Lumber. Lastly, West Fraser reopened its sawmill in McDavid, Florida. In total, these facilities represent 1,160 MMBF of lumber production.

To learn more about the 2014 Forisk Forecast or Forisk’s market-specific forecasts of softwood and hardwood stumpage and delivered prices tailored to individual wood-using facilities or timberland ownerships in the US, contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Leave a Reply