This post includes an excerpt from the feature article in the March/April/May 2014 edition of Wood Bioenergy US (WBUS) that explores how recent UK government decisions could affect US pellet exports and ultimately pine pulpwood price forecasts for the US South.

Pine pulpwood stumpage price forecasts in the 2014 Forisk Forecast include projections of pine pulpwood use by wood bioenergy projects. The largest proportion of increased wood demand for energy is attributed to wood pellet projects planning to export to customers in the UK and EU. However, a series of recent UK government decisions regarding CfD investment contracts creates uncertainty for biomass projects as well as pellet producers in the US that export to firms in the UK.

Recently, the UK government set boundaries on investments in renewable energy. For example, on April 23, 2014, the UK decided to award only one of Drax’s two planned unit conversions an “early investment” contract. Previously, in December 2013, the government excluded a large conversion project at Eggborough from early funding as it was declared not “provisionally affordable.” The UK has established limits with respect to funding allocations as well as the types of renewable investments that it will support.

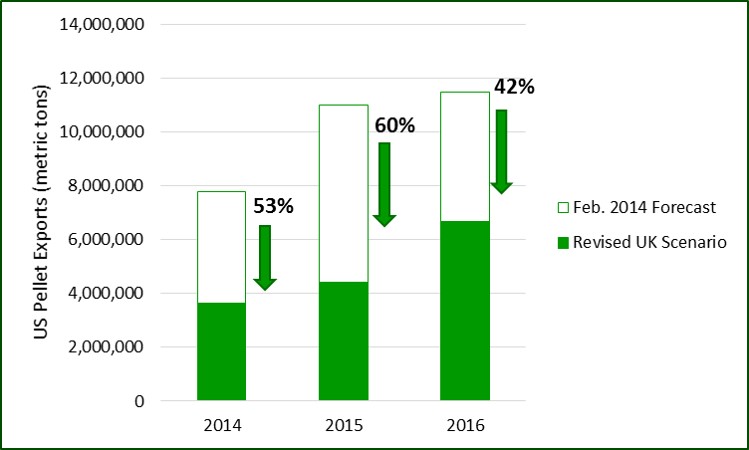

Forisk’s UK demand projections imply that pellet production capacity in the US will develop slower than expected, and will reach lower levels than expected given announcements by pellet developers. US pellet exports are projected to be 53% lower in 2014 than the pellet export manufacturing capacity projected in the Forisk Forecast, given recent UK announcements (Figure). This translates into 26% less pine pulpwood use for bioenergy in the US South in 2016 relative to the projection in the Forisk Forecast. Despite this decrease in expected pine pulpwood demand for bioenergy, the average stumpage price expectation for the South decreases by only 2% for 2016: from $12.32 per ton in the original Forisk Forecast to $12.07. The modest impacts reflect the facts that (1) bioenergy demand for pine pulpwood accounts for only 7% of total pine pulpwood demand in 2016 and (2) major price effects occur locally depending on the specific locations of failed pellet projects.

US Pellet Export Projections vs. Revised UK Scenario

WBUS Market Update: As of May 2014, WBUS counts 435 announced and operating wood bioenergy projects in the U.S. with total, potential wood use of 121.0 million tons per year by 2023. Based on Forisk analysis, 288 projects representing potential wood use of 80.0 million tons per year pass basic viability screening. To download the free WBUS summary, click here.

Leave a Reply