This is the second in a series related to Forisk’s 2014 mid-year forecast of U.S. timber prices by state and region.

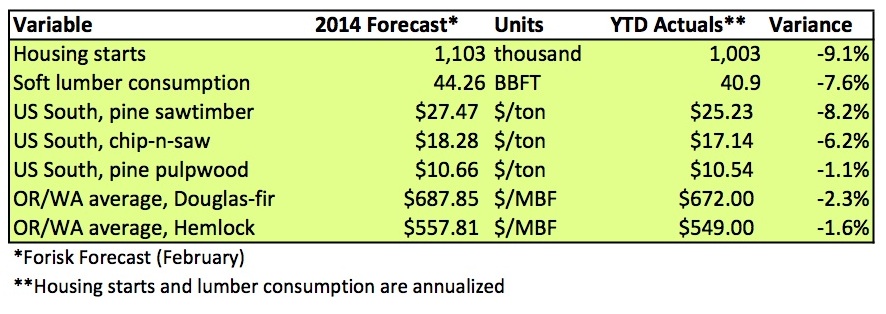

How has Forisk’s Forecast performed year-to-date for 2014? For pine stumpage prices in the U.S. South, the 2014 Forisk Forecast (February) was running 7.2% ahead regionally across all grade products and within 1.1% on pulpwood. Analyses of eleven state-by-state forecasts relative to Timber Mart-South actuals shows that Forisk was, on average, $1.51 per ton higher than the actual pine sawtimber prices and $0.57 per ton higher than the actual pine chip-n-saw prices. These results are consistent with the lower grade demand associated with slower home construction and lower lumber building product consumption. For pine pulpwood, Forisk’s YTD estimates for eleven state-level prices for 2014 were within $0.45 per ton for six states, while two states outpaced Forisk’s projections by more than $1.74 per ton (Florida and Louisiana).

For delivered softwood prices in the Pacific Northwest relative to those reported by Wood Resources International and the Oregon Department of Forestry, the February Forisk Forecast was 2.3% higher than actual YTD averages for domestic #2 delivered Douglas-fir along the Oregon/Washington coast, and 1.6% higher for domestic #2 delivered hemlock logs for the same region. Across categories in Oregon and Washington, Forisk projections overestimated YTD actuals for 2014 by, on average, $12.33 per MBF or 1.9%.

To learn more about the 2014 Mid-Year Forisk Forecast or Forisk’s market-specific forecasts of stumpage (timber) and delivered wood prices for individual wood-using facilities or timberland ownerships in the US, contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Leave a Reply