This is the sixth in a series related to Forisk’s 2014 mid-year forecast of U.S. timber prices.

An “A Team” of nine forestry scientists and policy analysts recently published a review of the research behind accounting for carbon emissions related to forest bioenergy (“Forest Carbon Accounting Considerations in US Bioenergy Policy” in the Journal of Forestry). This “SAF Carbon Report” boils down dozens of studies in a way that (1) provides proper context and (2) accounts for the role of local markets and economics in driving harvest decisions.

Provides Context

In 2013, we posted analysis of how reporters miss the forest and the trees when covering wood bioenergy markets and cited “failure to provide context” as one of three cardinal sins committed by media coverage of forest bioenergy. The SAF Carbon Report, on the other hand, provides proper context through comparing alternative scenarios and impacts. For example, if we really care about mitigating carbon emissions from forests over the long-term, what should we prioritize? The research speaks clearly on this question: avoid converting forestlands to other uses. Keep forests as forests. The authors emphasize the importance of proper timeframes and note, “as long as wood-producing land remains in forest…forest bioenergy reduce(s) fossil fuel use and long-term carbon emission impacts.”

Accounts for Bioenergy Markets and Forest Economics

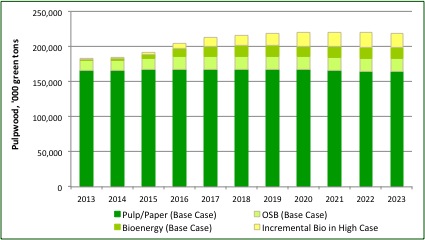

What if we choose to ignore the work of forestry’s leading scientists? To what extent does forest bioenergy drive forest use in the United States? Bioenergy projections in the Mid-Year 2014 Forisk Forecast provide additional context: wood bioenergy markets remain small consumers of pulpwood and chips relative to traditional forest industry markets (Figure). And this won’t change. As noted in a previous post, the economics of the pulp and paper sector and of OSB plants allow them to out-compete wood bioenergy projects for raw material seven days a week.

Pulpwood/Chips Use by End Market, U.S. South (Source: Forisk)

The SAF Carbon Report reinforces this theme, noting the critical role of wood demand, overall, in encouraging investments in forest health and productivity. Specifically, “increased demand for wood can trigger investments that increase forest area and forest productivity…” The discussion reminds us how private forest owners actually make harvest decisions when considering bioenergy markets.

In the end, a clear-eyed view of U.S. bioenergy markets as related to private forestland owner decision-making reminds us that a common formulation reverses the operational reality. Bioenergy markets do not drive U.S. forest management and use. Rather, U.S. private forest management – which prioritizes higher valued sawlog markets – serves to limit the potential growth of wood bioenergy markets.

To learn more about the 2014 Mid-Year Forisk Forecast or Forisk’s market-specific forecasts of stumpage (timber) and delivered wood prices for individual wood-using facilities or timberland ownerships in the US, contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Leave a Reply