This is the first in a series related to Forisk’s Q1 2015 forest industry analysis and timber price forecasts for the United States.

In forecasting timber prices and wood costs, we work to (1) identify and understand relationships in historical data and (2) quantify the “physical facts” on the ground in local markets related to supplies and capacity. From here, we infer future conditions and take positions on results moving forward. Part of “inferring future conditions” requires framing an economic context. Translation: what do we assume for US housing markets?

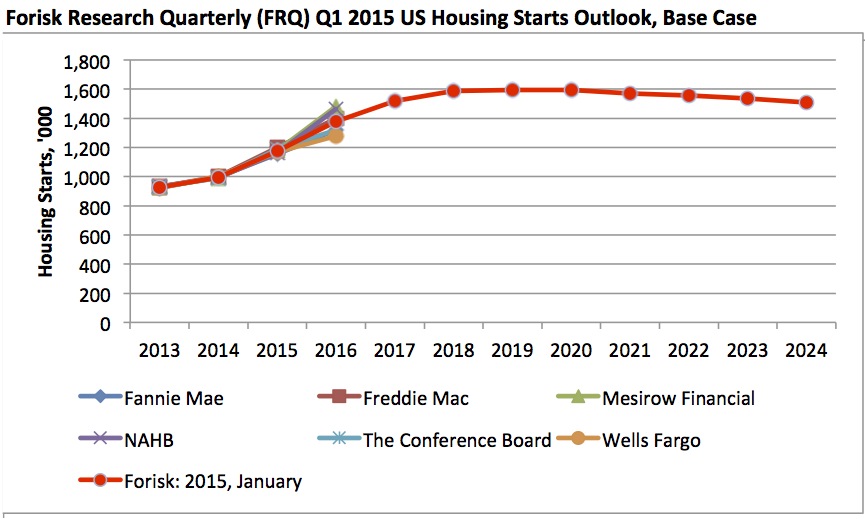

When updating our Forisk Research Quarterly forecast models, we revisit prior projections and review applied research on business and economic forecasting. For example, the literature guides Forisk’s Housing Starts Outlook, which combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Freddie Mac, Mesirow Financial, the National Association of Home Builders (NAHB), The Conference Board, and Wells Fargo, as well as long-term assumptions from the Congressional Budget Office (CBO) (Figure).

Forisk’s 2015 Base Case peaks at 1.60 million housing starts in 2019 before returning to a long-term trend approaching 1.51 million. For comparison, our August 2014 Base Case peaked at 1.58 million housing starts in 2019. Overall, Forisk’s housing start projections total 1.18 million for 2015.

To learn more about the Forisk Research Quarterly (FRQ), click here or contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Will the slowdown in the oil and gas exploration effect housing starts in 2015-2016? I believe it might have a small impact on overall housing. I would guess some of the best regions of housing starts have been where the oil and gas industry employment were the strongest?

For context, how have the various agencies you include in this consensus performed historically? Which one has tended to be optimistic (NAHB?) and which one has tended to be pessimistic (WF?) Does any one of them have a better track record? Secondly, what is the mix of SF and MF in your forecast and others – a big factor in lumber demand? Thanks, Brooks!