This is the third in a series related to Forisk’s Q1 2015 forest industry analysis and timber price forecasts for the United States.

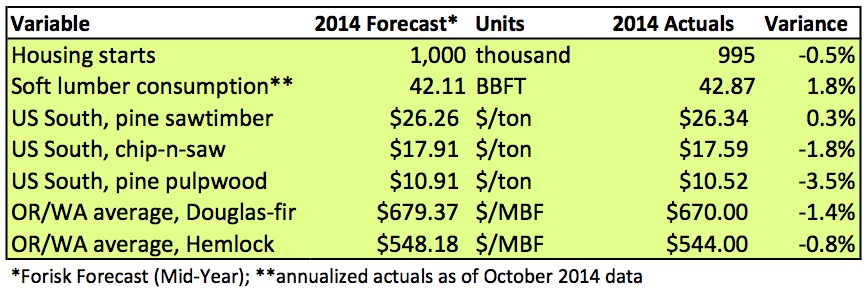

Before projecting forward, we ground ourselves by looking back and evaluating the performance of previous forecasts and earlier models. How did Forisk’s Forecast perform in 2014? For pine stumpage prices in the U.S. South, Forisk Mid-Year 2014 projections ended the year within 0.3% for pine sawtimber, within 1.8% for chip-n-saw and within 3.5% for pulpwood. Analyses of eleven individual state-by-state forecasts relative to Timber Mart-South actuals shows that Forisk was, on average, $0.88 per ton higher than the actual pine sawtimber prices and $0.46 per ton higher than the actual pine chip-n-saw prices. For pine pulpwood, Forisk’s 2014 estimates for eleven state-level prices for 2014 differed by $0.10 per ton on average. In grade markets, two states outpaced Forisk’s projections by more than $2.00 per ton for sawtimber (North Carolina and Texas). In pulpwood markets, two states outpaced Forisk’s state-level projections by more than $1.00 per ton (Louisiana and South Carolina).

For delivered softwood prices in the Pacific Northwest relative to those reported by Wood Resources International and the Oregon Department of Forestry, the Mid-Year Forisk Forecast was 1.4% higher than actual YTD averages for domestic #2 delivered Douglas-fir along the Oregon/Washington coast, and within 1% for domestic #2 delivered hemlock logs for the same region. Across categories in Oregon and Washington, Forisk projections overestimated 2014 actuals for 2014 by, on average, $6.78 per MBF or 1.1%.

To learn more about the Forisk Research Quarterly (FRQ), click here or contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Leave a Reply