This post includes excerpts from the Q1 2015 Forisk Research Quarterly (FRQ) chapter on timberland investment vehicles and ownership.

Institutional investors looking to add timberlands to their portfolios and timber REITs looking to grow their asset base both face the challenge of identifying attractive, investable candidates from a market with limited supplies of quality properties. For strategy analysis and assessments of relative competitive advantage, we watch this closely as it speaks to growth for REITs and operational viability for TIMOs. The big question remains, “what does the pipeline of timberland properties look like?” It’s a competitive environment and investors and firms want to acquire quality assets without sacrificing long-term returns.

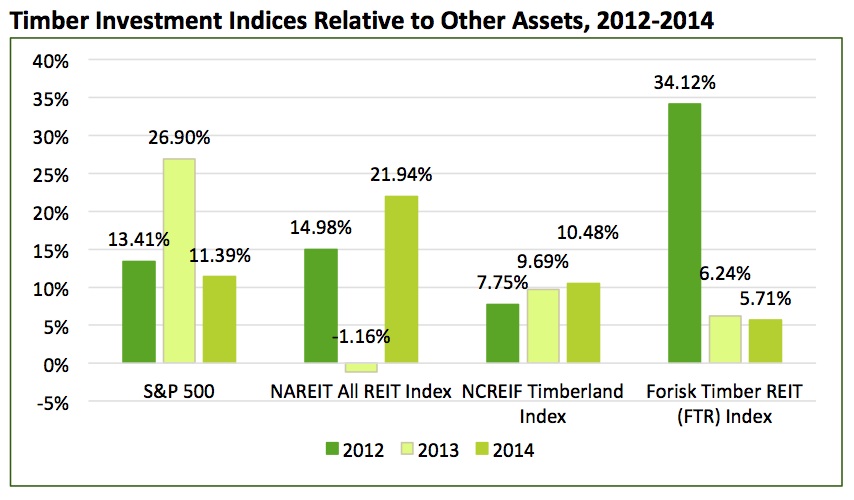

Timberland investment vehicles underperformed broader market benchmarks in 2014.

Timberland investment vehicles, while continuing to generate positive returns, lagged both the S&P 500 and the publicly traded real estate sector. The National Council of Real Estate Investment Fiduciaries (NCREIF) reported 2014 total returns for private U.S. timberlands of 10.48%, which marks the fourth consecutive year of improved returns. The figure below compares by year, for 2012 through 2014, the performance of indices tracking the S&P 500, all publicly traded real estate investment trusts (NAREIT), private timberlands (NCREIF) and publicly- traded timberland-owning REITs (Forisk Timber REIT Index (FTR)). Timber REITs in the FTR Index for 2012 and 2013 include Plum Creek (PCL), Potlatch (PCH), Rayonier (RYN) and Weyerhaeuser (WY). The 2014 figures also include CatchMark Timber Trust (CTT).

Source: Q1 2015 Forisk Research Quarterly

Firm-specific issues and slower-than-expected wood demand and housing accounted for most of the relative underperformance in the timber REIT sector for 2014.

Timberland owning REITs work to achieve growth in at least two primary ways. First, they look to optimize the performance of the assets in their existing portfolios. These assets fund dividends, debt service and operations. Second, they look for growth opportunities that improve the overall quality of the portfolio of assets and translate this into dividend growth for shareholders. Portfolio improvement is a strategy of selling bottom-tier or “less desirable” or “less strategic” assets and replacing them with higher-quality (timberland) assets. This recipe is true for timberland portfolios generally, for REIT firms generally, and for timber REITs explicitly.

For 2014, the FTR Index of timber REITs showed positive returns because Weyerhaeuser, the only firm with meaningful positive stock price appreciation, accounts for 57% of the timber REIT sector’s market capitalization. Including dividends, sector level total returns were 9.94% for the year. Overall, performance lagged from slower housing markets and the associated muted timber pricing and volumes in core grade categories. In short, lower demand for lumber resulted in lower demand in logs resulted in lower than expected cash flows. This made maximizing the existing assets in the current market less impactful to results.

To learn more about the Forisk Research Quarterly (FRQ), click here or contact Brooks Mendell at bmendell@forisk.com, 770.725.8447.

Leave a Reply