This post includes an excerpt from the bioenergy research published in the Q2 2015 Forisk Research Quarterly (FRQ) Publication.

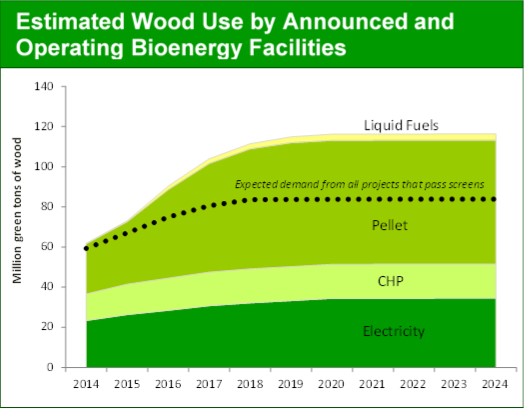

Wood bioenergy projects have slowed in the U.S.; meaningful potential growth, if realized, will occur in the next five years. The figure below details estimated wood use through 2024 associated with bioenergy by project type in the United States. All announced projects and operating plants represent potential wood use of 117.6 million tons per year by 2024. Based on Forisk analysis, 299 projects representing potential wood use of 83.9 million tons per year pass basic viability screening. The “estimated demand from all projects” dotted line reflects the application of Forisk’s screening to all 424 operating and announced projects tracked in Forisk’s wood bioenergy database as of April 24, 2015 (down from 430 projects as of January 30th). Projected wood use from all projects by 2024 is down from the January 2015 estimate by 5.5 million tons per year; part of this decrease is due to cancelled and shut down projects. Projected wood use from projects that pass viability screens falls below the January 2015 estimate by 1.8 million tons.

Regionally, the U.S. North still has the largest share (47%) of viable wood bioenergy projects while the South accounts for 53% of the potential wood use for bioenergy. Regionally, the South leads the United States in bioenergy investment as measured by potential wood use and energy generation. In comparing the viability of projects by region, we find 61% of all announced and operating projects in the South pass Forisk screening, while the North and West reach 78% and 71% respectively. In part, this reflects the longer history of in-place and smaller operating projects in those two regions, while larger projects locate in the South for reasons of scale, access to resources and access to ports and markets.

The single largest source of growth in U.S. wood bioenergy markets remain pellet projects planned and under construction in the South built to serve export markets to the U.K. and EU. See the blog post, “How Can Global Demand for Wood Pellets Affect Local Timber Markets in the U.S. South?” that details Forisk’s analysis of the impact of wood pellet projects in the U.S. South on local pulpwood prices.

Leave a Reply