December 2015 included multiple global confabs and ripples in the space-time continuum. In Los Angeles, “Star Wars: The Force Awakens” opened. The movie had a record opening weekend, bringing in $248 million in North America alone. In Paris, a United Nations summit on climate change closed with an agreement designed to limit increases in global temperatures. This climate pact includes commitments from 195 countries. And in Montreux, Switzerland, the Programme for the Endorsement of Forest Certifications (PEFC) hosted “Forest Certification Week.”

How do these events inform and affect forest owners and timber investors?

- In Star Wars, we learned that light sabers can saw trees, thank you very much. With a few modifications, the (non-carbon emitting) energy blade could also prove a superior tool for pruning and herbaceous weed control by solo forestry practitioners or forestland owners.

- The UN climate conference elevated the role of forests in efforts to offset carbon emissions. The climate pact references “results-based payments”; “policy approaches”; and “positive incentives” for actions related to sustainable forest management. In short, checks will be written to forest owners somewhere and somehow.

- Forest certification programs, which continue to expand their coverage, remain one of the more tangible regulatory exposures affecting timber REITs and timberland investors. And they provide a potential avenue for implementing climate pact policies in forestry.

Forest Certification Refresher

Forest certification includes third-party programs that signal responsible forest management based on an audited set of criteria. Established forest certification programs in North America include:

- Sustainable Forestry Initiative (SFI). In 2005, PEFC endorsed SFI, giving it international recognition.

- The Forest Stewardship Council (FSC), based in Oaxaca, Mexico, is a major international certifier.

- The American Tree Farm System (ATFS) supports a program for nonindustrial family forest owners in the United States.

Generally, landowners enrolled in SFI or FSC programs are industrial owners that participate in certification as an industry standard and to satisfy investor requirements for sustainable management and public relations. Typically, small or nonindustrial private landowners either participate in ATFS or not at all.

Timber REITs and Forest Certification

Relative to forest owners generally, public timberland owning firms participate in U.S. forest certification programs at higher rates. The five public US timber REITs – Weyerhaeuser, Plum Creek, CatchMark Timber, Potlatch, and Rayonier – certify 100% of their U.S. timberlands.

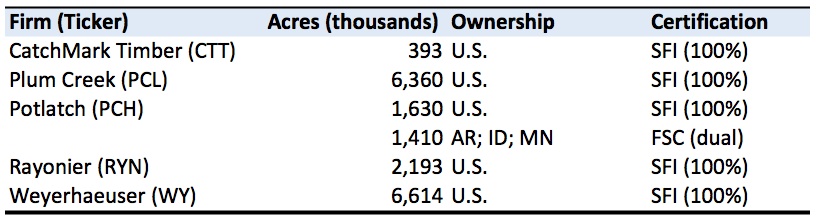

The table below summarizes timber REIT U.S. acres enrolled in forest certification programs. SFI certifies all U.S. timberland owned by these firms, as well as some Canadian acres. FSC certifies a small portion of U.S. land as well as acres in New Zealand. Potlatch holds 100% dual certification from SFI and FSC for land holdings in Arkansas, Idaho, and Minnesota. Land managed by Rayonier in New Zealand is certified by FSC. Lands managed by Weyerhaeuser in Canada are certified under SFI.

Table: Certified Forest Acreage Held by U.S. Timber REITs, 2015

Moving forward, we watch the public timber REITs, because of their relative transparency, and the forest certification programs, because of their growing infrastructures, as sources of information on how certification and global climate pacts affect forest management and investment returns.

Forisk intern Chantal Tumpach supported the research for this blog post.

Leave a Reply