Timberland investors often use timber REIT dividend yields and U.S. Treasuries as inputs, proxies or reference points for discount rates applied to valuation models. In the case of Treasuries, 2016 opened with the 10-Year and 30-Year at 2.24% and 2.98%. Over the past three weeks, equity markets continued to play pickle with timber REIT shares (and, as a result, yields) along with the S&P 500.

Through January 22nd, the S&P dropped 6.7%. In the case of timber REITs, all five firms, while down YTD, remain subject to strong investor interest thanks to the announced Plum Creek-Weyerhaeuser merger. Still, per the Forisk Timber REIT (FTR) Index, the timber REIT sector has dropped 14.8% for the year.

How do timber REIT dividend yields compare to private timberland discount rates of 5.0 to 6.5%? Each public timber REIT pays quarterly cash dividends. On an annualized per-share basis, these total:

- CatchMark (CTT): $0.50

- Plum Creek (PCL): $1.76

- Potlatch (PCL): $1.50

- Rayonier (RYN): $1.00

- Weyerhaeuser (WY): $1.24

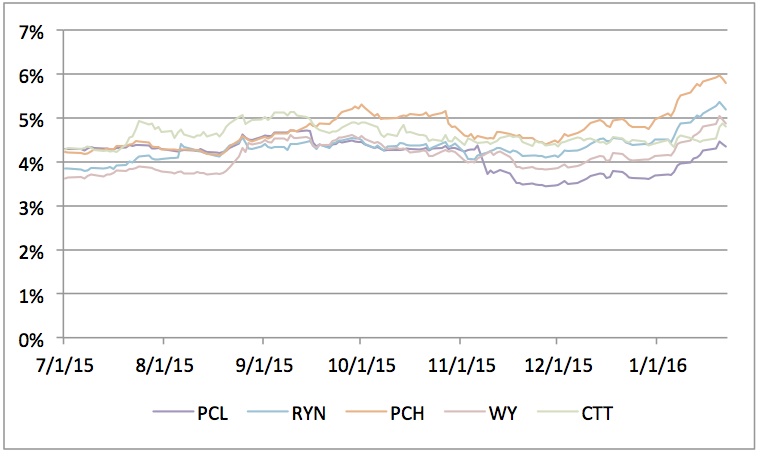

Weyerhaeuser made the last change to dividends, increasing quarterly distributions by 6.9% in August 2015, from $0.29 ($1.16 per year) to $0.31 ($1.24 per year). The figure below plots dividend yields (annualized dividends divided by closing share price) over the last six months of 2015 through January 22nd, 2016.

Timber REIT Dividend Yields, 7/1/15-1/22/16

Current timber REIT yields now “approach” discount rates commonly applied to recent timberland transactions. While timber REIT yields averaged 4.34% at the close of 2015, the recent declines in equity prices pushed average yields up to 5.13% on January 20th (with Potlatch nearly high-fiving 6%) and closed at 5.00% on January 22nd.

To subscribe to the free weekly FTR Index Summary and to obtain historical FTR Index data in an Excel format, please sign up here or contact Heather Clark at hclark@forisk.com.

Leave a Reply