Forisk tracks wood-using facilities in North America’s forest products industry to study capital allocation, wood demand, and forest technology trends. Demand for logs from sawmills drives timber prices in most local markets and affects timberland values. Over the past 20 years, the lumber industry consolidated and recapitalized as the number of sawmills declined while the average mill size increased. Canadian firms purchased U.S. mills and established a presence in the U.S. market. Who are the top lumber producers in the U.S. today?

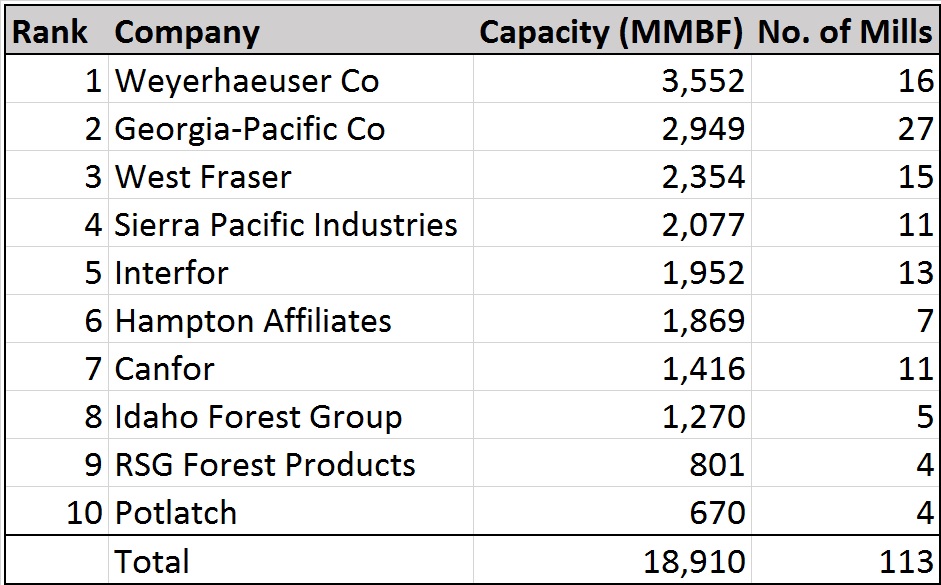

Weyerhaeuser ranks number one for lumber production capacity, followed by Georgia-Pacific. The top 10 lumber producers in the U.S. have the capacity to produce 18.9 billion board feet of lumber and own 113 sawmills. This represents 40% of the softwood and hardwood lumber production capacity of mills in the U.S.

Three Canadian firms – West Fraser, Canfor, and Interfor – make the top 10 list. Interfor has U.S. mills in the South and West, while West Fraser and Canfor only have a presence in the South. Four of the companies in the top 10 only own sawmills in the West: Sierra Pacific, Hampton Affiliates, Idaho Forest Group, and RSG Forest Products. The two largest producers – Weyerhaeuser and Georgia-Pacific – and Potlatch own assets in multiple regions.

When we expand the list to include the top 20 producers, a hardwood company makes the cut: Northwest Hardwoods (#18). Biewer Lumber makes the list at #17 with the recent addition of a new sawmill in Newton, Mississippi that started up in January 2017.

Forisk Senior Analyst Justin Tyson contributed to the research in this blog post.

Leave a Reply