This post includes excerpts from previous research published by Forisk and summarizes comments we delivered at the Who Will Own the Forest? Conference in Portland, Oregon on September 13, 2017.

Decades of “nightly news” exposure to investment indices such as the Dow Jones and S&P 500, with their long histories and deep data sets, make us take investment indices and reliable benchmarks for granted. In contrast, for alternative investments (such as timberlands), benchmarks often serve as incomplete indicators, a challenge described in The Wall Street Journal (“Benchmarking Alternative Funds an Inexact Science,” April 10, 2014). The article notes that alternative-fund benchmarks function well as a “guidepost” but not as true metrics for individual investments. This can prove problematic for institutions seeking guidance when making investment decisions, and evaluating asset managers.

The National Council of Real Estate Investment Fiduciaries (NCREIF; pronounced “nay-creef”) publishes the most widely referenced indices for private U.S. timberland investments and managed by timberland investment management organizations (TIMOs) on behalf of institutions. In previous research on benchmarking, (“Best Practices and Existing Indices for Privately Held Timber Assets”, Q3 2015 Forisk Research Quarterly), Forisk detailed seven (7) criteria for evaluating timberland indices such as NCREIF.

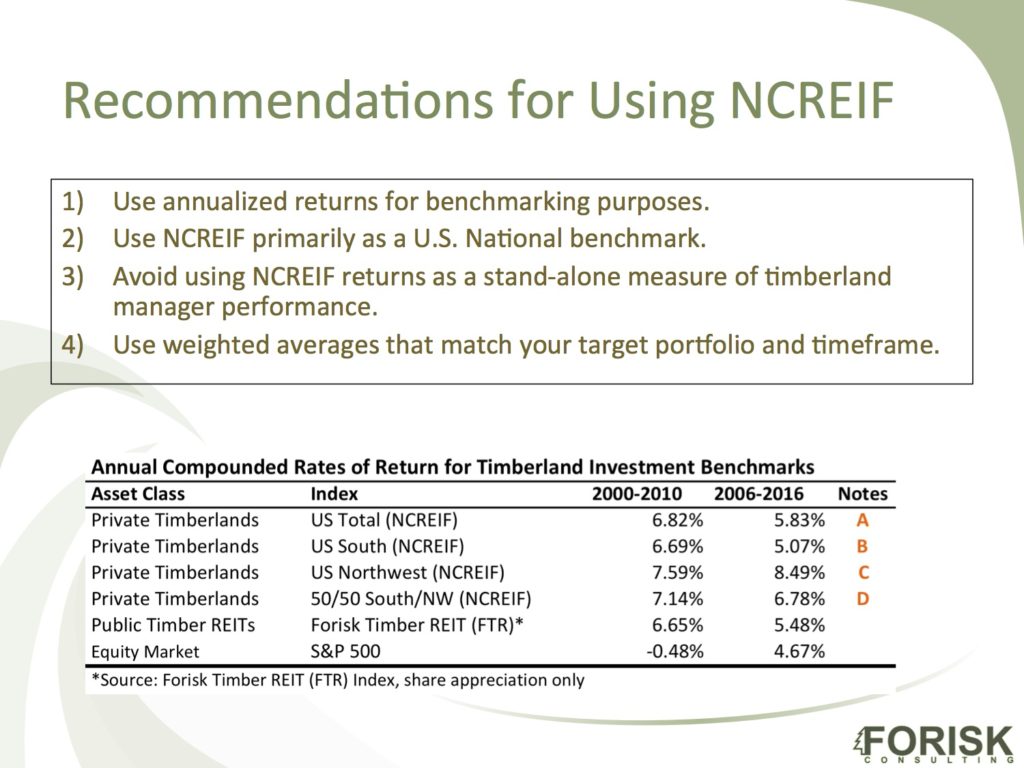

Forisk applies criteria and frameworks when assessing investment benchmarks and developing pricing mechanisms for wood supply agreements or transfer pricing. These criteria evolved over time for a range of timber markets and applications related to evaluating firm and investment performance. Applying the benchmark criteria to the NCREIF Timberland Index resulted in four (4) recommendations for investors and managers who want the maximal use of NCREIF without abusing its capabilities.

First, use annualized returns for benchmarking purposes. NCREIF reports timberland investment results quarterly. However, inconsistencies in periodic appraisals and the lagging implications associated with appraisal-based real estate indices (such as NCREIF) generally question the use of quarterly returns for performance analysis. Simply, the annual appreciation and income measures have proved useful, helpful and robust for timberland investment tracking.

Second, use NCREIF primarily as a U.S. National benchmark; avoid using regional measures outside of the South (or Northwest). NCREIF reports timberland investment returns in four U.S. regions: South, Northwest, Lake States, and Northeast. However, NCREIF’s tracking is heavily weighted to the South, which currently accounts for 70% of the acres in the index.

Third, avoid using NCREIF returns as a stand-alone measure of timberland manager performance. NCREIF does a better job of summarizing returns through economic cycles from professionally managed, industrial timberlands than it does of comparing manager skills, strategies or cost effectiveness. We suggest supplementing the use of NCREIF with assessments of communication skills, performance reliability, and annual variance analysis of pro-forma budgets. This could include third party benchmarking of forest management costs. The bottom line is, does your manager (or lawyer, accountant, consultant, etc.) do what they said they were going to do when they said they were going to do it, and do they communicate this well. You also want to clarify the day-to-day realities of what the manager accomplished on your behalf while dealing with exogenous factors outside of their control.

Finally, use weighted averages of the NCREIF regional indices that match your portfolio composition and timeframe. The figure below includes a table with four versions of the NCREIF Timberland Index over two different timeframes, as well as the Forisk Timber REIT (FTR) Index of pubic timber REITs and the S&P 500. Line “A” shows how the National Index returns vary for different time periods. Lines “B” and “C” show annual compounded returns for “South” only and “Northwest” only timberland portfolios. The data shows how the regions varied in level and direction of returns. And line “D” includes a 50/50 weighting of the South and Northwest. The take home message is that NCREIF can, and therefore should, be matched to one’s timberland investment portfolio as best as possible.

In practice, compiling relevant benchmarks for specialty sectors – such as timber – can require resources, the development of transparent processes, and sufficient consensus across investors and managers. The recommendations in this applied research provide simple guidance on how to use NCREIF appropriately and to maximum benefit.

Forisk will teach “Wood Flows & Cash Flows” in Atlanta on December 7h, a one-day event that reviews and applies research and analysis to investments and forecasts across the forest industry supply chain, from timberlands to mills owned privately and by publicly traded firms.

Leave a Reply