This is the second installment in our discussion of the 2017 Hurricane season’s impacts on the forest industry. See Part I for additional analysis. Brooks Mendell, Andrew Copley and Justin Tyson contributed to this blog.

The closest comparison we have for the current hurricane impacts of Irma and Harvey are Katrina and Rita in 2005. Those storms flooded a major metropolitan area, as did Harvey, and caused substantial wind damage, as did Irma. A difference is that the 2005 storms overlapped one area. With the disaster now unfolding in Puerto Rico following Hurricane Maria, disaster funding and response are spread over a massive geography. Still, we have clues to how this might affect rebuilding and the housing industry going forward. The data and previous analysis indicate that key drivers include the role of federal funding on rebuilding activity and the decisions of families who choose between rebuilding or moving and resettling elsewhere.

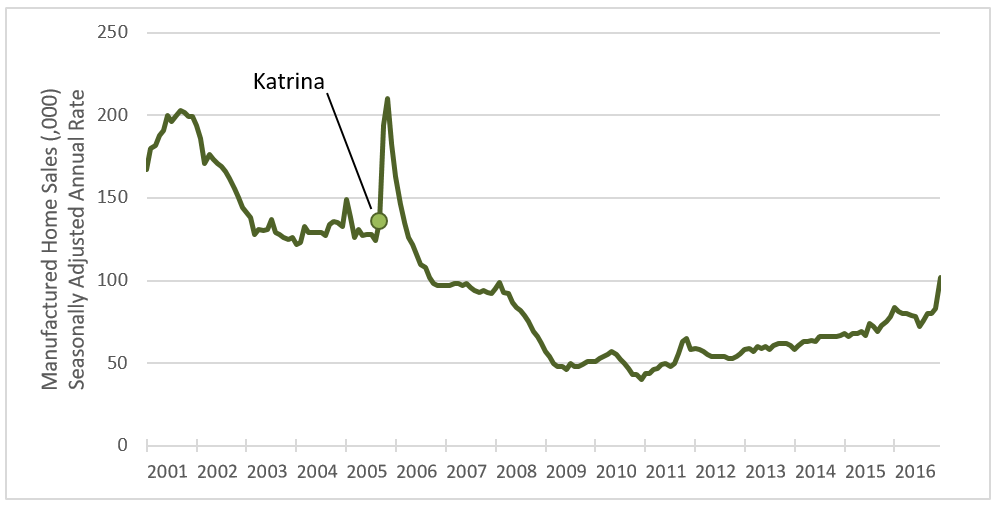

The 2005 hurricanes destroyed 125,000 homes and damaged over 1 million, which created a booming market for lumber and building materials. While Harvey did not destroy as many homes in Texas, the aggregate destruction of the 2017 storm season remains unknown. Displacement of 1 million people in the Gulf region following Katrina caused a massive spike in pre-fabricated home sales (Figure 1). At one point, FEMA housed over 100,000 families in trailers. With residents still returning to the Florida Keys, FEMA already ordered 4,500 new manufactured homes to support Harvey victims in Texas.

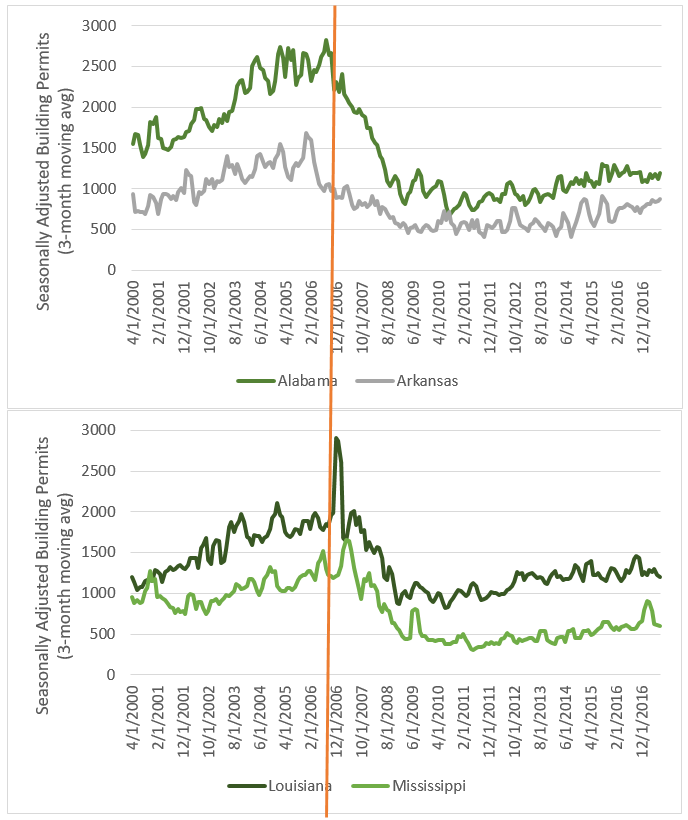

In 2005, the storms struck just before the housing market in the US started to collapse, making a direct analysis of the housing market implications today a bit challenging. By comparing construction activity in Louisiana and Mississippi to that in Arkansas and Alabama, it appears that federally aided rebuilding activity in 2005 delayed the start of the housing decline by 10-12 months (Figure 2). Given the lack of flood insurance reported in much of the affected areas of Texas, federal funding may have a similar slow, supportive effect on reconstruction. While the Small Business Administration already distributed $500 million in loans to help Texans start rebuilding, the scale of the destruction across the southern states and Puerto Rico suggests additional funds designated by Congress will be needed to rebuild fully.

Many of those displaced by Katrina in 2005 never returned to the damaged areas, also muddying the picture on housing effects. Three years after Katrina, the population of New Orleans was 30% lower than prior to the storm. The total population is still reportedly 10% lower than pre-Katrina. The displacement from the 2017 storms does not appear as substantial or likely in Texas. Residents of the Florida Keys are still returning to their homes, so we will soon learn if the devastation will prevent a measurable portion of the population from rebuilding. The damage in Puerto Rico seems likeliest to cause a migration from the island to the mainland for those citizens who can afford it. While New York has the largest population of Puerto Ricans outside the island itself, the fastest growing population on the mainland is Florida, potentially offering an additional source of new housing demand in the coming months.

Forisk will teach “Wood Flows & Cash Flows” in Atlanta on December 7h, a one-day event that reviews and applies research and analysis to investments and forecasts across the forest industry supply chain, from timberlands to mills owned privately and by publicly traded firms.

Leave a Reply