Last week Forisk hosted a “Wood Flows & Cash Flows” event in Atlanta where we discussed a range of our research applications. Included were detailed case studies and rankings of markets and wood demand, forest supplies, timberland ownership, bioenergy, and supply chain/operations. We also discussed key risks to smooth functioning of our wood supply chain. One theme was the need to keep the effect of these risks in perspective, as not all are equally likely nor equally impactful.

Perspective can be a useful thing. In the film Glengary Glen Ross, Alec Baldwin’s character lays out the prizes for a sales competition among a group of four real estate salesmen, “…first prize is a Cadillac Eldorado…Second prize is a set of steak knives. Third prize is you’re fired.” That’s quite a lesson about risk and perspective (not to mention motivation). Missing out on first prize might seem lousy, but at least you have a job (and a set of knives).

We’ve written in the past about the risks facing the supply chain in the form of truck insurance. There’s a high probability of significant insurance cost increases in the near future. A much lower probability is that insurance companies stop covering log trucks. Higher premiums are going from a Cadillac Eldorado to a set of steak knives. It’s not great. The insurance industry abandoning the logging sector is a definite third prize. If we can’t insure our trucks, we can’t operate. Given those choices, I’ll take the knives.

Another substantial challenge we face in hauling is the need for more truck drivers. That growing need is rapidly pushing salaries higher. With forecasts for continued increases in lumber production moving forward, we will need more trucking capacity to haul more sawtimber to sawmills. Indeed, the 18% growth we’ve seen over the last four years in log truck driver salaries may continue. It’s another set of steak knives. If we fail to provide higher salaries, we will lose drivers to competing industries and the hauling capacity would fall short of meeting the industry’s wood demand.

The takeaway is that all signs point to higher hauling costs in the future. For our discussion on supply chain risks, I estimated worst-case, near-term outcomes and suggested truck insurance costs per ton might double and labor costs might increase 25%. We can argue the scale of those changes, but given current hauling costs in the Southeast, that would translate to roughly $1.25 per ton greater hauling costs. The impacts would be greater in the West and North where per ton (or MBF) haul costs tend to be higher.

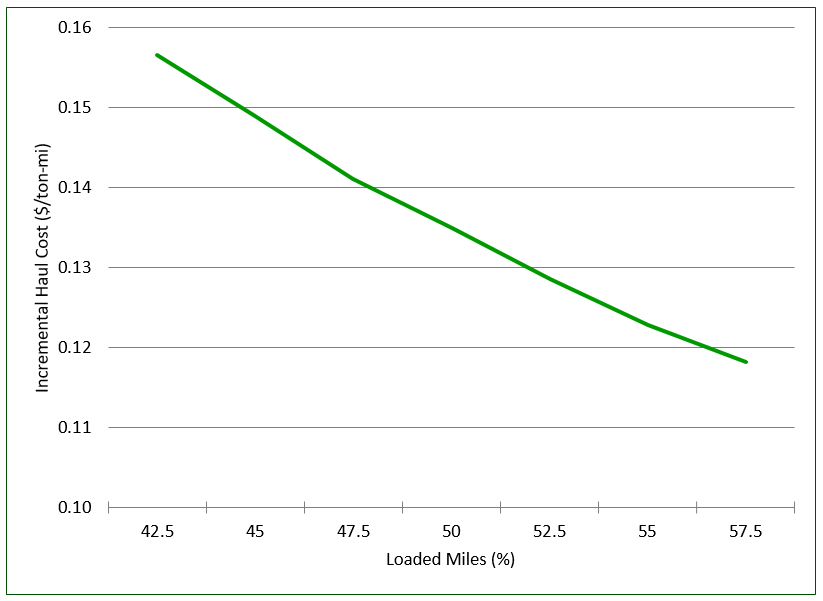

Not all is lost, though. Log hauling remains inefficient, and slight improvements can yield significant savings. As part of our Q1 2017 research into salaries, we estimated the sensitivity of haul costs to increased trucking productivity (Figure). Operating trucks fully loaded for 50% of the miles they drive as opposed to 45% would drop operating costs by $1 per ton or more. This is no small feat, but it highlights the potential savings. Insurance providers also point to training and fleet maintenance as ways to secure lower insurance rates. In the end, there are no easy solutions, but we must maintain our perspective. Costs will increase in our supply chain, but we can find ways to mitigate the impacts and avoid the high-risk outcome of major disruptions. Besides, who doesn’t like a good set of steak knives?

Leave a Reply