In our previous post, we discussed timber market drivers and the “rough-hewn relationship between housing, lumber and timber.” Now, we consider regional analyses for localized investment strategies to best-position our mills and timberlands. While trees grow and markets cycle, regional markets have unique profiles that follow their own patterns and timelines.

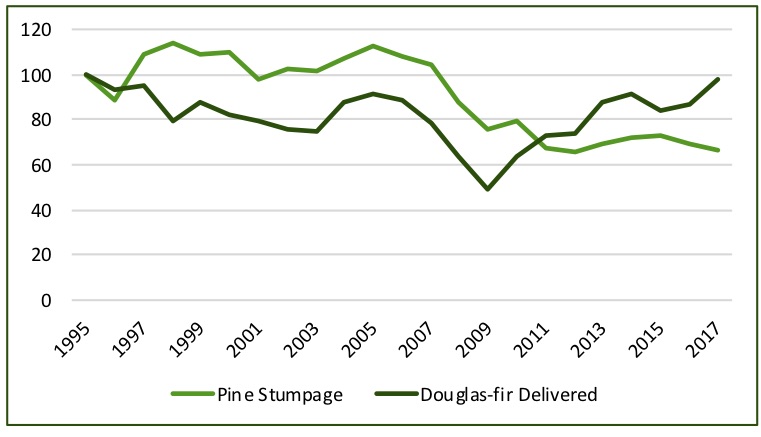

Over the past ten years, log prices in the South and Pacific Northwest (PNW) have been a tale of two markets. Since 2009, delivered Douglas-fir sawlog prices doubled, while Southern pine sawtimber prices dropped about ten percent. However, this time frame requires the context of history. Twenty years ago, we saw this story in reverse, with prices surging in the South and sliding in the PNW (Figure). Current western prices, in nominal terms, simply returned to where they were in 1995.

Indexed Domestic Sawlog Prices: South versus Pacific Northwest (1995=100)

Source: Q2 2018 Forisk Research Quarterly (FRQ); data: ODF; WRI; LMR; TMS

Our general outlook, that domestic sawlog prices in the West are bouncing around an effective “maximum” range, is informed by physical constraints and shifting capacities in the sector:

- Few opportunities for growing log consumption exist in the PNW. The regional market is supply constrained. While there have been a few meaningful mill investments (e.g. Sierra Pacific’s new sawmill in Shelton, WA), there have also been closures and downtime due to scarce raw material supplies. And much of the net increase in lumber production comes from mill efficiency, not more logs.

- PNW prices are running at or near long-term highs (depending on how you measure them). When we model prices and get results outside of the normal distribution, we need an operable “story” that accounts for physical and economic realities to justify the position. Otherwise, we must acknowledge the elevated prices for what they are: elevated spikes desperately looking for a release valve. Which brings us to a final reality…

- The PNW is at a competitive disadvantage to the South. While the log and timberland markets are not fungible in this way, the economics of the industry continue to push log demand and lumber production South. Each year, the South gains a little US market share, which aligns with the capital investment story. And from a timberland investment perspective, we view the PNW as a cash flow story and the South as a growth story.

Two primary levers would or could drastically change our outlook. One is the log export market. Incremental changes in Chinese demand and Canadian flows affect directly PNW price outlooks. Two is log supply. We have evidence of localized harvest patterns affecting localized prices, which vary by forest owner type.

All of this reinforces the need to watch, track and analyze the forest industry capacity across North America by market and mill type. In Q3 2018, Forisk will publish a comprehensive analysis of North American wood-using mills. This Study details current capacity by firm and sector across North America, along with projected capacity levels by sector and region for the next two years. This analysis supports strategic and operational plans for wood-using mills or timberlands in the U.S. and Canada.

Forisk will discuss forest industry investment frameworks during “Timber Market Analysis”on June 19th in Atlanta. For more information, click here. This post excerpts analysis from the Forisk Research Quarterly (FRQ).

Leave a Reply