On February 28th, NCREIF – the National Council for Real Estate Investment Fiduciaries – sent out a note regarding a restatement of the Q4 2018 Timberland Property Index. Timberland investors, investment managers, and industry researchers and analysts (e.g. Forisk) often cite this index for benchmarking private timberland investment performance. NCREIF’s note included the following summary:

The Fourth Quarter 2018 NCREIF Timberland Property Index has been restated due to a significant reporting error on one property. The impact at the National Level is a 22 basis point total return drop…

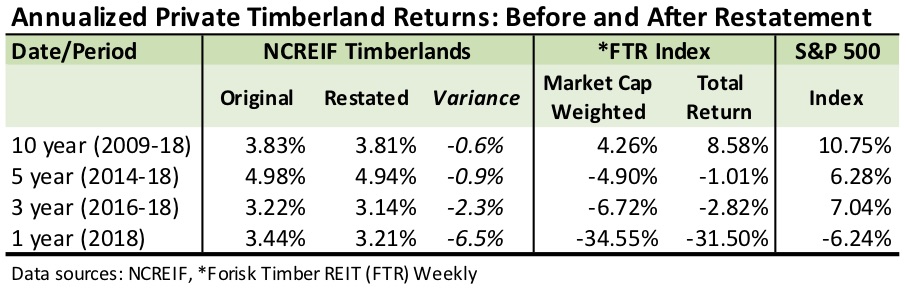

So how does this restatement affect the multi-year metrics we use for estimating long and short-term performance? The table below summarizes the implications by comparing multi-period, annualized results before and after the restated returns versus select benchmarks.

Overall, the restated Q4 2018 returns have minimal impacts for comparing the U.S.-wide timberland returns over longer times spans, such as 5 and ten years. For example, the restated numbers for the past ten years dropped 0.02% (from 3.83% to 3.81%). Alternately, the restatement dropped 1-year 2018 returns by 22 basis points, from 3.44% to 3.21% (rounded). For comparison ten-year U.S. Treasuries yield (as of today) about 2.90% and the 30-year yields 3.06%.

Still, private timberlands, when compared to public REITs and the S&P 500 in the table, retain their relative stability and positive cash flow generation, regardless the time frame. [Fortunately for many investors and 401K plans, 2019 YTD has seen a bounce in equities; as of the March 1st Forisk Timber REIT Weekly, public timber REITs returned 13.81% versus 11.84% for the S&P 500.]

In sum, know and remember why you want timberlands in the portfolio. You don’t really buy timberland to outperform the market. Objectives such as wealth preservation matched with realistic return expectations provide a useful starting point. In addition, timberlands generate some cash and diversify the portfolio (and provide a place to hike, fish and hunt…).

Leave a Reply