We get introduced to the concept of substitution in elementary school. When Mrs. Schlesinger in third grade is unavailable due to illness or car trouble and Mr. Carson, a substitute teacher, fills in admirably for a day or a week, we learn that everyone, and everything, is replaceable. Yay.

Michael Porter, in a 1979 Harvard Business Review article, highlights the threat of substitutes as one of five key forces affecting the competitiveness of an industry. Substitutes comprise products or services which offer similar benefits to customers as a company’s own products or services. Viable substitutes threaten and constrain the growth and profit potential of a business or industry. As prices for the products in one industry increase, the substitutes from another industry or market become relatively more competitive and attractive to customers. The threat of substitute products persists across the forest industry.

Our previous Forisk Strategy Note shared specific learnings related to evaluating risk and capital deployment based on a decade of research related to North America’s wood bioenergy sector. This Note summarizes historical research of the structural panels sector and analysis from Forisk multi-client studies to address the question, “how and when should substitutes concern executives and investors in the forest industry?”

North American Structural Panels Sector

Structural panels date back to the Portland Manufacturing Company in 1905, when Carlson and Bailey constructed the first piece of structural plywood (S. Sinclair 1992). Early applications included niche markets such as door panels, trunk stock, and furniture drawer bottoms. Real growth, though, waited until after World War II. Since the late 1960s, combined structural panel production for the U.S. and Canada grew over 100% from nearly 17 billion square feet (BSF) to over 36 BSF last year.

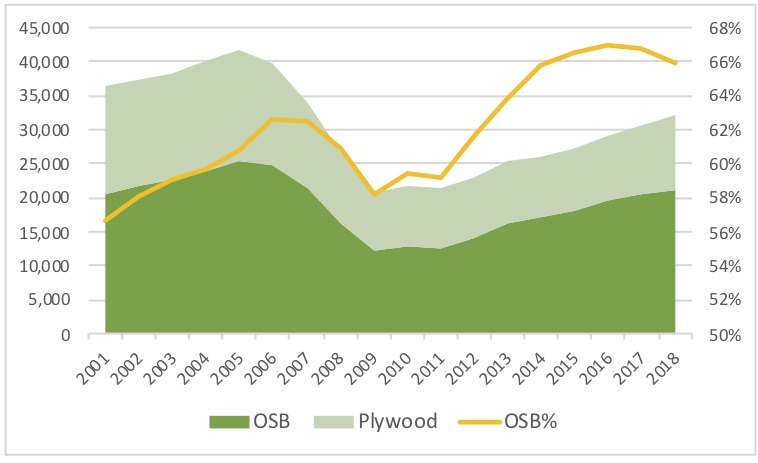

The tremendous growth of structural panel production aggregates a set of products and geographies battling for market share. Consider the U.S., where oriented strand board (OSB) continues to erode market share from plywood following the recession. Figure 1 summarizes how OSB went from 57% of U.S. structural consumption to 66% over the past two decades.

Figure 1. U.S. Structural Panel Consumption by Type (BSF) and OSB Market Share (%)

Data source: APA

The history of structural panels in North America includes a range of substitutes, from western plywood and waferboard to southern plywood and OSB. Part II introduces lessons related to assessing products as competitive threats over time.

Leave a Reply