In a previous post about timber REITs, I quoted Mark Cuban, owner of the NBA’s Dallas Mavericks and investor on Shark Tank, on stocks and dividends:

I believe non dividend stocks aren’t much more than baseball cards. They are worth what you can convince someone to pay for it.

The quote resonated as dividend-paying stocks, and REITs in particular, have gained coverage recently as a fundamental part and strategic asset when building an investment portfolio. Investors value REITs for their regular and reliable income generation, and for their diversification. According to research by the National Bureau of Economic Research, REITs tend to follow the real estate cycle, which often lasts a decade or more, while stocks and bonds move in cycles that average just under six years.

In addition to income, dividends provide information. They offer a window into what management sees and thinks. Consider a move in 2011 by Potlatch (now PotlachDeltic) during the earliest years following the recession, where they reduced dividends and harvest levels. We noted at the time that these moves “[reflected] sound, investment-strengthening decisions to protect long-term shareholder interests.”

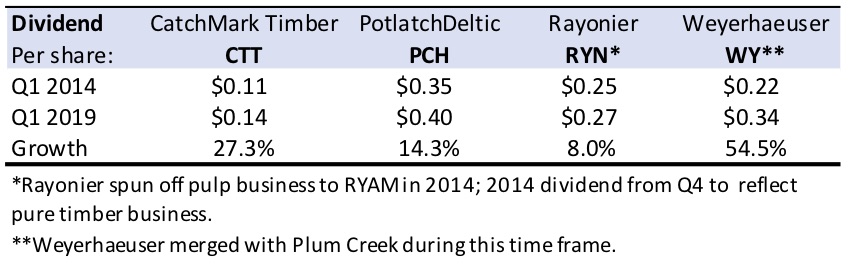

Recently, I reviewed the status of dividend growth from the public timber REITs. Here’s a five-year snapshot. On average, the public timber REITs grew their quarterly dividends 26% over this period.

Timber REIT Growth, Q1 2014 to Q1 2019

And they are not alone. As James Glassman noted recently in Kiplinger’s,

“…investing in stocks that pay dividends—especially rising dividends—turns out to be a terrific strategy. The S&P 500 Dividend Aristocrats index has returned an annual average of 18.3% over the past 10 years, compared with 17.1% (including dividends) for the S&P 500 as a whole.”

Firms pay dividends out of free cash flow, so they also align with a philosophy of conservative corporate management. Executives will avoid unnecessary risks that jeopardize distributions, while also seeking opportunities to increase dividends. When senior executives and Boards raise dividends, they reflect a form of confidence and expectation for growth.

To subscribe to the free weekly FTR Index Summary and to obtain historical FTR Index data in an Excel format, please contact Heather Clark, hclark@forisk.com.

Leave a Reply