According to Greg Ip in The Wall Street Journal (3/3/2020), “Epidemics historically haven’t been disruptive enough to affect gross domestic product much…That probably won’t be true this time” with respect to the coronavirus. A primary reason: the growing impact on demand from closing schools and large-scale events, which reduce the use of services related to travel, hotels, restaurants, and entertainment.

Picture a movie theatre that continues to show films even as no one arrives to buy tickets. The days pass and the films show, but no popcorn gets sold or seats filled. Now and more broadly, we’re flying fewer planes and canceling conferences in addition to skipping theatres. This lost economic activity, perishable and unrecoverable, gets subtracted from our original expectations for 2020. How long until people start attending the theatre again?

With the coronavirus, analysis of supply side (supply chain) and demand side disruptions varies widely. We struggle to quantify the size and duration of the potential economic impacts. So, we turn to frameworks and scenarios.

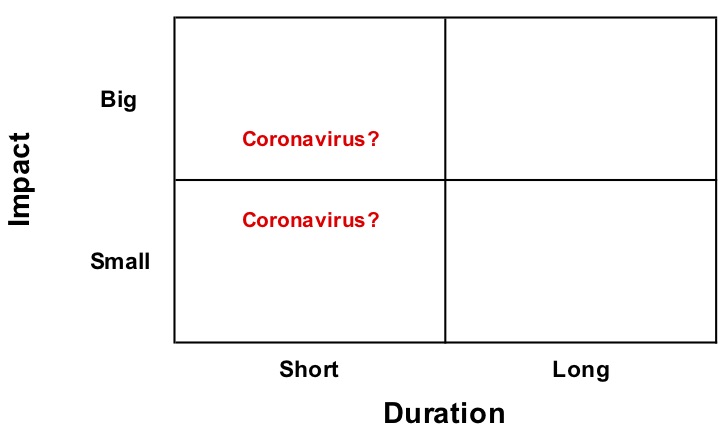

Part I of this series revisited our framework for evaluating disruptions to businesses and specific industries. Consider the exposure of timberland owners to coronavirus-related disruptions:

- Big or small? No forest supply effect; varying local impact on wood demand.

- Long or short? Short-term decrease to demand; no long-term impact on value.

Graphically, the framework affirms the expected short-term impact from the coronavirus (in isolation). Its current progression mirrors previous pandemics; it will likely be in the rear-view mirror one year from now and investors will still hold timberlands. However, the magnitude of the short-term disruption is unclear. Will it simply slow wood demand for a quarter or will it disrupt forest industry cash flows for all of 2020?

Mapping Potential Timberland Owner Disruptions from the Coronavirus

The framework also reminds us to beware analysis in isolation. The coronavirus epidemic occurs in a larger context, one where trade policy impacted the forest industry and global economies began slowing in 2019. For this exercise, we assess potential disruptions from exponential growth in coronavirus infections over the next few months through a set of simple scenarios.

In Part III, we leverage two variables – GDP and housing starts – to connect the dots and scale the implications for the U.S. forest industry.

Click here to read and download the complete Q1 2020 Forisk Strategy Note on this research.

Leave a Reply