This post includes an excerpt from Forisk’s upcoming white paper “Timberland 2020: From High Hopes to Viral Mopes and Back Again.”

The current pandemic and market volatility give us the chance to revisit the thesis and long-term benefits of owning and retaining timberland investments as part of a diversified portfolio. Opportunities to participate in timber evolved over the past 50 years as ownership of investment-grade timberlands in the U.S. shifted from the forest products industry to forest management specialists such as TIMOs and public real estate investment trusts (timber REITs).* While some acreage went to developers or small landowners, most was acquired by institutional investors attracted by the cash flows, diversification and inflation-hedging characteristics.

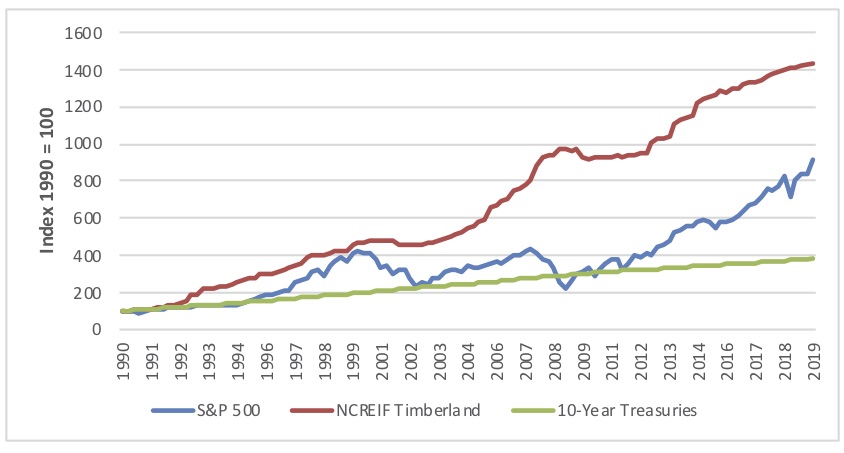

Over the long-term, privately-owned timberlands continue to exhibit strong risk-adjusted returns relative to assets such as stocks and bonds (Figure). Timberland investments benefit from the fact that they comprise a diversified bundle of businesses. A given forest can serve multiple, often countercyclical, markets including hardwood and softwood, grade and pulpwood, along with non-timber markets such as recreation, minerals and cell towers.

Performance of Private Timberlands Relative to Stocks and Bonds

Over the past thirty years, a preliminary survey of the data indicates timberland satisfied its mandate. An investment of $100 in the S&P 500 in Q1 1990 would have appreciated to $914.20 by the end of Q1 2020, not including dividends. The same $100 invested in private timberlands would have appreciated to $1,426.22 over the same time frame.

*Mendell, B.C. 2016. From Cigar Tax to Timberland Trusts: A Short History of Timber REITs and TIMOs, Forest History Today, Spring/Fall 2016: 32-36.

Brooks, I am not advising anyone to get into timberland right now because I think the last 10 years’ experience is much more relevant than the last 30 years. Nothing in the fundamentals looks bright until timberland prices drop steeply. One can make a case that demographics will push forest products consumption but I think the old relationship between demographics and homeownership has changed, perhaps permanently. And the southern inventory overhang just keeps growing and growing…

Sam: totally understand that point of view. In surveying investors and consultants over the past few weeks, two “themes” include (1) the belief/hope/wish for a quick rebound since the demographics are favorable and (2) the prospect for some repricing in certain markets if or when investors need cash. For those already in the asset class, timber appears to be doing its job (preserving wealth, diversifying). Thank you for reading and commenting!

I got $9.5/ton on pulp (1st thinning) in 2015 on 17 yr J Hancock plantation planted lob lolly.Similar to housing – what did you pay on front end? I was able to get for less that $1100/ac. If I can get $18 for CNS in 2-4 yrs, I feel that’ll be a good IRR. Thanks – Love blog.