This post includes notes on the application and adjustment of discount rates during periods of historically low interest rates, with examples related to timberland investments. This continues a discussion from my February 2020 post addressing questions related to discount rates and the coronavirus.

In finance, asset values estimated via discounted cash flow (DCF) analysis get affected by (1) changes in the benchmark risk-free rate and (2) the premium that investors require above this rate to hold the given asset, whether T-Bills, shares of T-Mobile or tracts of timberlands.

The risk-free rate and risk premium affect the discount rate, the numeric lightsaber analysts use to quantify risk and account for the time value of money. Generally, high discount rates reflect high risk and low discount rates indicate low risk. Reducing uncertainty can increase value in tangible ways as it allows the use of lower (“less risky”) rates leading to higher values in today’s dollars. Overall, investors simply want to match the discount rate to the specific risk of a project.

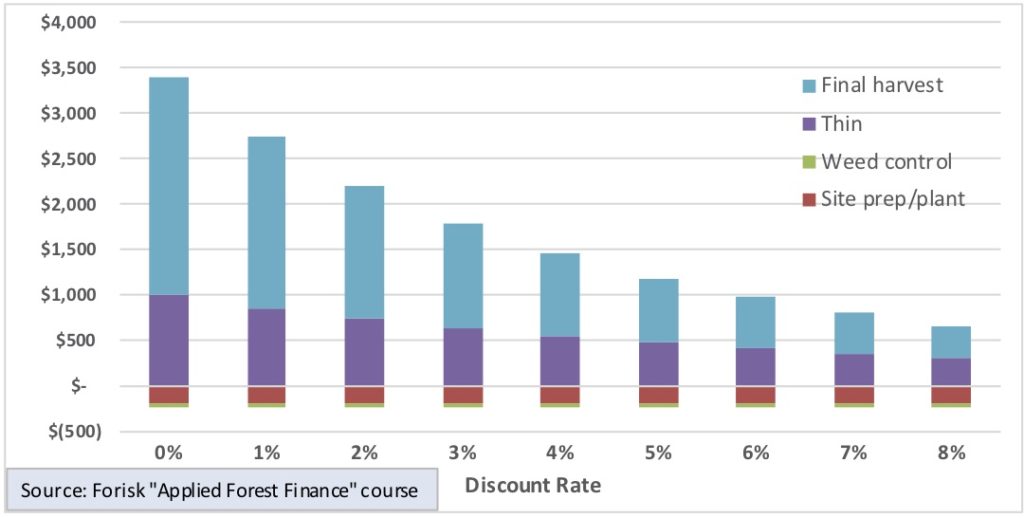

Numbers outperform words when it comes to clarifying the critical role of discount rates in asset valuation. Consider the sensitivity analysis applied to a timberland investment in the figure below. In this example, the forest requires investments totaling $235 per acre within the first year, and then generates per acre cash flows of $1,000 in 15 years and $2,400 in 25 years. The undiscounted cash flows total $3,165 per acre. As we increase the discount rate, the net present value (NPV) falls, with the greatest declines taking place from changes in the lowest discount rates.

Net Present Value (NPV) at Different Discount Rates

Looking back, years of low interest rates encouraged borrowing by firms and justified low discount rates in DCF models across industries, including timberland. That creates the exposure captured in the figure, where low rates magnify the effect on values of small changes in rates.

Looking forward, low discount rates in DCF analysis extends the relevance of risks and disruptions occurring far into the future. Think of the math at play here. Discounting $1,000 received in 50 years at 10% delivers $8.52 in present value, barely enough for a burger and fries. Discount that same $1,000 in 50 years at 1.43% (the yield on 30-year U.S. Treasuries as of today, July 1, 2020) equals $491.68 today.

At 10%, disruptions in 30 or 40 years have little impact on the analysis in terms of value today. At 1.43%, events in 30 or 40 years materially affect the net present value. In addition, the reduced impact of time on value from low discount rates creates an analytic tradeoff, turning once marginal projects into viable ones, even if nothing else changed in the assessment of the (timber) asset (or the local wood markets).

How, as analysts, do we contemplate these issues in our work? If rates are “historically” or “unsustainably” low, we can account for this with additional risk premiums, as the signal from the low interest rate provides its own indication of risk and concern about the economy. One place to look for guidance on the increment is the actual borrowing costs of firms in the (timber and forest products) industries relative to treasuries.

At the end of the day, we want the timberland valuation and the wood market analysis to stand up based on the merits of their (1) bottom-up facts and (2) top-down attractiveness relative to other assets and markets in that industry. The discount rate, in this view, is baselined to the long-term cyclical risk of the industry first and then adjusted to account for the specifics of the local asset and market.

It will be interesting to watch “timber” investment returns unfold especially from those investments which are leveraged (by debt, by timber supply agreements, by certain investors having preferred returns, etc.), that have concentrated (geographic) holdings, who are depended on HBU sales, and who have a relative short term investment horizon (say under 25 years).

Agreed. Each of those elements, while offering potential safety (e.g. supply agreements) or incremental returns, injects constraint on generated cash flows and how they could be deployed, especially in the case of matching a long-term asset to a short-term investment vehicle. Thank you for reading and taking the time to comment.

This article would also suggest that management investments in publicly owned forest lands are subject to higher uncertainty since the discount rates used on these lands is often lower than privately held forest land investments. This uncertainty continues to hamper internal competition for funding allocation and management decisions.

Thank you for this comment and insight. Yes, it implies an assumed stasis on public forests, an unchanging situation in perpetuity when, in fact and practice, we know forest change, burn and evolve, as does their context.

Thank you for this article. Foresters have often argued for lower discount rates because of the long-term nature of the industry and many forestry projects cannot be financially justified without lower rates. However, you raise the important point that those same low discount rates also mean that future risks become more important in a project’s consideration. Forestry has been seen as a low-risk enterprise, but only if there is geographic (and possibly species and product) diversification. Lower discount rates mean that future environmental risks for small forest landowners should not be ignored because their impact in present value terms may well no longer be relatively insignificant. And it may be that with climate change, even geographic diversification may not be enough to mitigate environmental risks.