A client posed the question last week “what are the implications to the logging industry of a $15 minimum wage?”. It is a great question. With many logging businesses in rural areas, offering some of the best wages in those locales, what will doubling the legal minimum wage do to this vital link in the wood supply chain? The Bureau of Labor Statistics offers detailed data on employment and wages giving us a glimpse of the possible impacts.

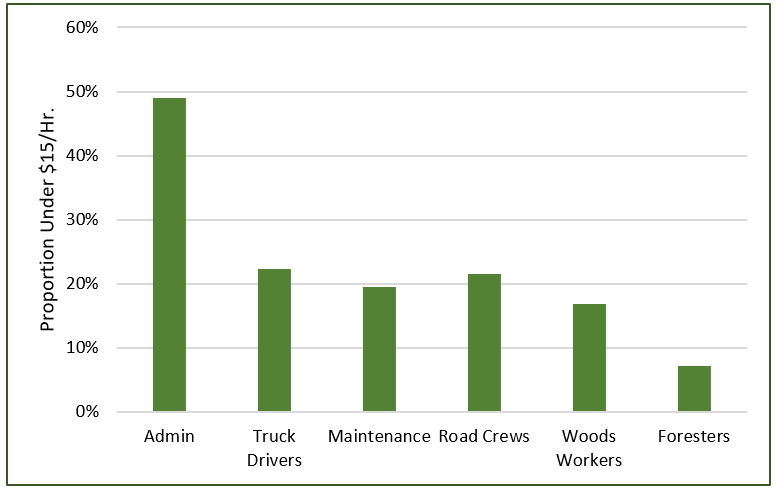

Nationally, the median hourly wage of logging business employees was $20.46 in 2019[1]. When we think of logging jobs, our minds are often drawn to the men and women harvesting the trees and delivering them to mills. In the case of the minimum wage hike, however, the logging industry is exposed to many of the same dangers as our economy. The critical support jobs are among the lowest paid (Figure 1). Of the 10,000 jobs in logging businesses earning less than $15 per hour, roughly 7,000 are in-woods workers (equipment operators, timber fallers, etc.) or truck drivers. The remaining 3,000 are in other roles. Nearly half of the administrative and office support jobs in logging earn less than $15 per hour. Around 20% of the repair and maintenance staff and road building crews are also under the threshold.

The last recession showed woods workers and truck drivers are least likely to lose their roles during financial crises. Loggers are more likely to fund higher wages by either cutting support jobs or raising their contracted rates. If the industry were to shoulder higher costs without cutting any staff (an unlikely outcome given the scale of the change), the total payroll of the industry would increase around $48 million, or roughly $0.10 per ton for every ton harvested in 2019. The average hourly wage for the entire industry would increase $0.50 per hour.

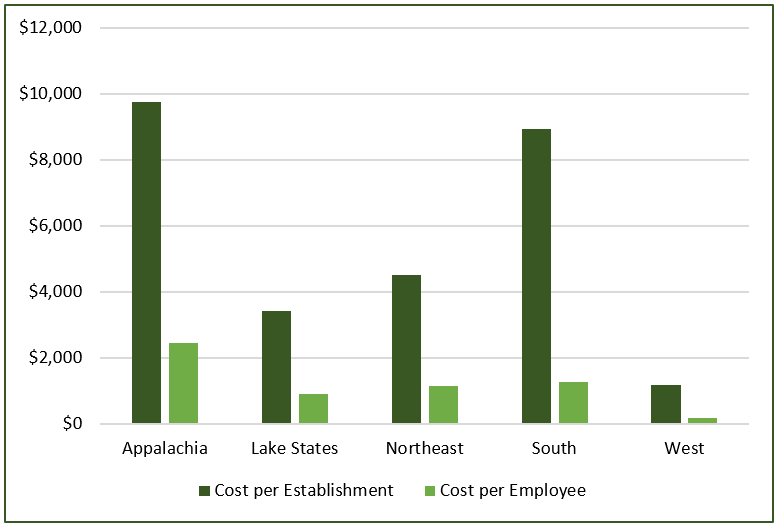

Geographically, the effects are not uniform. In the Pacific Northwest, far fewer employees earn under $15 per hour than in Appalachia or the South. The average payroll increase for a western logging business would be $1,200 per year, while an average Appalachian logging business would add nearly $10,000 per year (Figure 2). Again, these costs would not be felt uniformly within a region. Larger, well-capitalized businesses with higher average pay rates would have few increases, while smaller businesses would likely need to raise pay for a greater proportion of their staff.

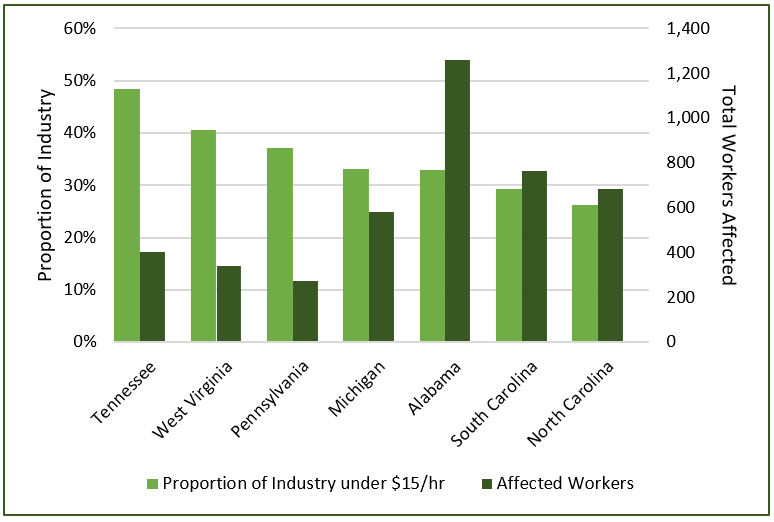

It is difficult to know how the industry might react. In seven states, over one-quarter of the logging industry earns less than $15 per hour (Figure 3). While all these states are in the east, they are dispersed across the Lake States, Mid-Atlantic, Appalachian, and Southern regions of the country, highlighting the geographic extent of the industry. Such a drastic wage shift is likely to force some loggers out of business. Capacity might contract, and logging costs are likely to increase. The risk to administrative support will almost certainly make managing logging businesses more challenging for owners, opening gaps in accounting and slowing the flow of paperwork. One of the key exposures as administrative help shrinks? Payroll.

[1] We will use 2019 data for this analysis. Data from 2020 have not been published for some of the datasets we use and 2019 was a “typical” year without some of the turmoil that might skew our analysis, like a once-in-a-generation pandemic.

Leave a Reply